Presents the profitability of your business by subtracting all applicable expenses from your total income. Most companies apply A.

Cash Flow Statement Beginners Guide Youtube

Cash Flow Statement Beginners Guide Youtube

As expected CFF is.

Cash flow statements for dummies. The cash flow statement measures how well a company manages. Covers how to read cash flow statements Illustrates how cash balances are analyzed and monitoredincluding internal controls over cash receipts and disbursements plus bank account reconciliation and activity analysis. Tìm kiếm understanding cash flow statements for dummies understanding cash flow statements for dummies tại 123doc - Thư viện trực tuyến hàng đầu Việt Nam.

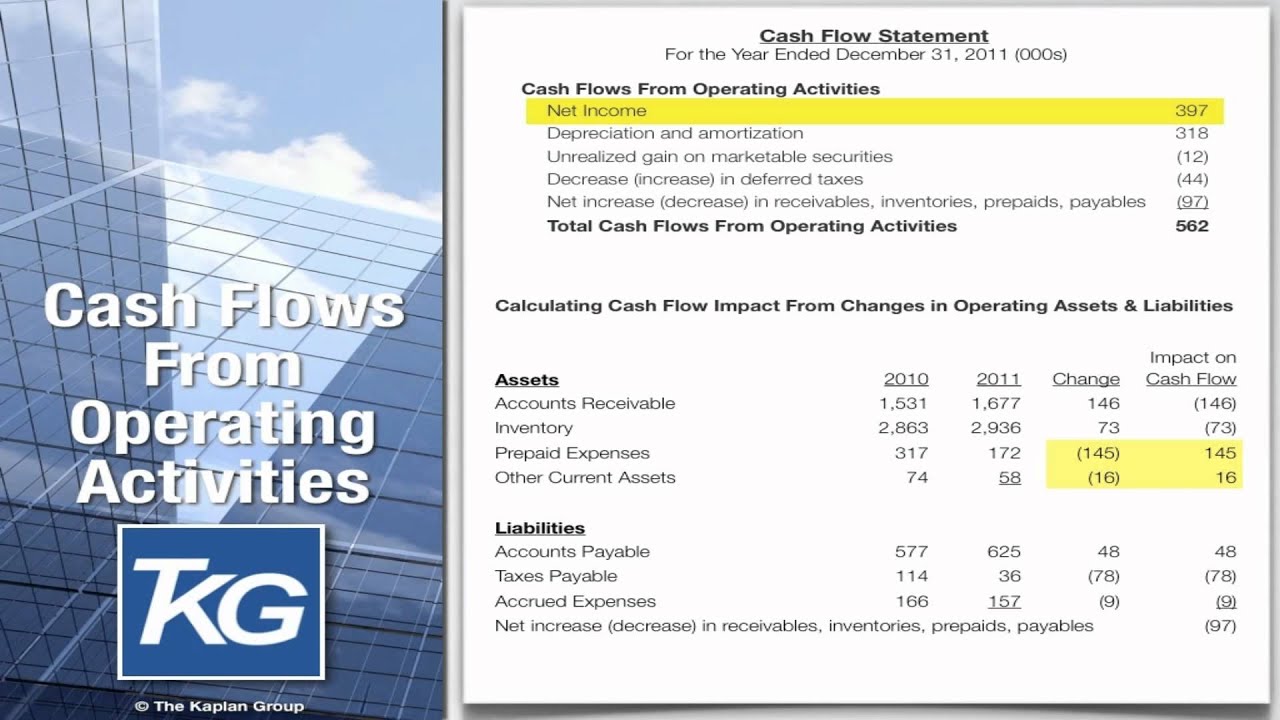

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. Cash flow from financing CFF includes cash received inflow for the issuance of debt and equity. The report allows for management and investors to see how a companys operations are running where the money is coming from and how it is being spent.

The Financial Accounting Standards Board FASB prefers the direct method while many businesses prefer the indirect method. Meanwhile the financing activities reduced Cash by 25000. You can see the statement of cash flows breaks into three sections.

The goal of the cash flow statement is to provide an accurate picture of the cash inflows outflows and net changes of cash during the accounting period. Operating activities investing activities financing activities and supplemental information. The indirect and direct methods.

Here is the bank T-account for the sample business weve been using throughout our tutorials Georges Catering. Heres a simplified version. It means that there are more Cash Inflows than Cash Outflows thus the Operating and Investing Activities of the business increased the Cash balance of the company.

The statement of cash flows or cash flow statement summarizes the significant reasons for the change in a companys cash and cash equivalents during a period of time. The Cash Flow Statement is one of the 3 main Financial Statements. A companys cash flow statement records the movement of cash over a period of time.

So one would look over the bank T-account and possibly the cash receipts journal and cash payments journal if needed. Two methods are available to prepare a statement of cash flows. The items are presented in the following categories.

The cash flow statement measures a companys liquidity solvency turnover and financial health so its an important consideration when doing a thorough financial statement analysis. Cash Flow For Dummies gives you an understanding of the basic principles of cash management and its core principles to facilitate small business success. Along with the balance sheet and income statement the cash flow statement is a required element of a companys financial reports.

Cash Flow Statement Template. The cash-flow statement converts the accrual basis of accounting to a cash basis. Notice in our sample Cash Flow Statement that the Cash Flow from Operating and Investing Activities is positive.

Provides a breakdown of the cash inflows and outflows of your business and shows how much actual cash on hand you have at the end of a given period. Tìm kiếm cash flow statements for dummies cash flow statements for dummies tại 123doc - Thư viện trực tuyến hàng đầu Việt Nam. The cash flow statement provides an overview of how a company generates and spends cash over a given period.

It will show you how effective a business is in managing its cash. Instead of looking at what youve earned and what you owe it looks at what youve collected and spent and it lets you see at a glance whether more cash is going out than coming in or vice versa. CoolGadgets cash flow statement starts by showing how much cash it had at the start of the year then tracks how much cash flowed in and out in three main areas operations investment and financing and finishes by adding it all up to show how much was left at the end of the year.

The statement is prepared by calculating net changes to cash from operating investing and financing activities. To determine whether or not you should invest in a company or buy its bonds taking a look at the financial statements of the company in question is a mustT. The cash flow statement can be drawn up directly from records of ones cash and bank account.

Operating activities investing activities and financing activities which can help investors and analysts understand how the company. It breaks down company cash activities into three categories.