Would you trade 15955 for 100 right now. Calculate your paper price.

How To Use The Excel Pv Function Exceljet

How To Use The Excel Pv Function Exceljet

Show detailed computations in your Excel spreadsheet.

Calculating present value in excel. PV ratenperpmt fv type. In this tutorial you will learn to calculate Net Present Value or NPV in ExcelIn this tutorial you will learn to calculate Net Present Value or NPV in. Show detailed computations in your Excel spreadsheet.

First we calculate the present value pv of each cash flow. To better understand the idea lets dig a little deeper into the math. Dont use plagiarized sources.

The syntax for present value in excel is. Present Value 96154 92456 88900 85480 Present Value 362990 Therefore the present day value of Johns lottery winning is 362990. This means that you will need to divide the annual interest rate by the number of compounding periods in the year.

Present Value for all the year is calculated as. The Excel function to calculate the NPV is NPV. The formula for present value is PV FV 1rn.

To calculate NPV you need to know the annual discount. NPV discount rate series of cash flow. The Excel PV function is a financial function that returns the present value of an investment.

50 in 2 years is worth 3781 right now. The NPV or Net Present Value is the present value or actual value of a future flow of funds. Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column.

Pmt is the regular payment per period if omitted this is set to the default. Make sure that you have the investment information available. The NPV function in Excel only calculates the present value of uneven cashflows so the initial cost must.

Nper is the number of periods over which the investment is made. Present Value 1 0 5 1 5 1 1 0 0 beginaligned textPresent Value frac 105 1 5 1 100 endaligned Present Value 1 5 1 1 0 5 1 0 0. Using the Excel PV Function to Calculate the Present Value of a Single Cash Flow.

Rate is the interest rate per period as a decimal or a percentage. 25 in 1 year is worth 2174 right now. To know the current value you must use a discount rate.

Next we sum these values. NPV PV of future cash flows Initial Investment. Most financial analysts never calculate the net present value by hand nor with a calculator instead they use Excel.

Present Value Function Syntax. 15209 in 3 years is worth 100 right now. The present value of a future cash flow is the current worth of it.

Using Excel as a Time Value of Money Calculator calculate the present value of your investment. The auto feature automatically calculates various functions and recalculates every time a value formula or name is changed. Get Your Custom Essay on.

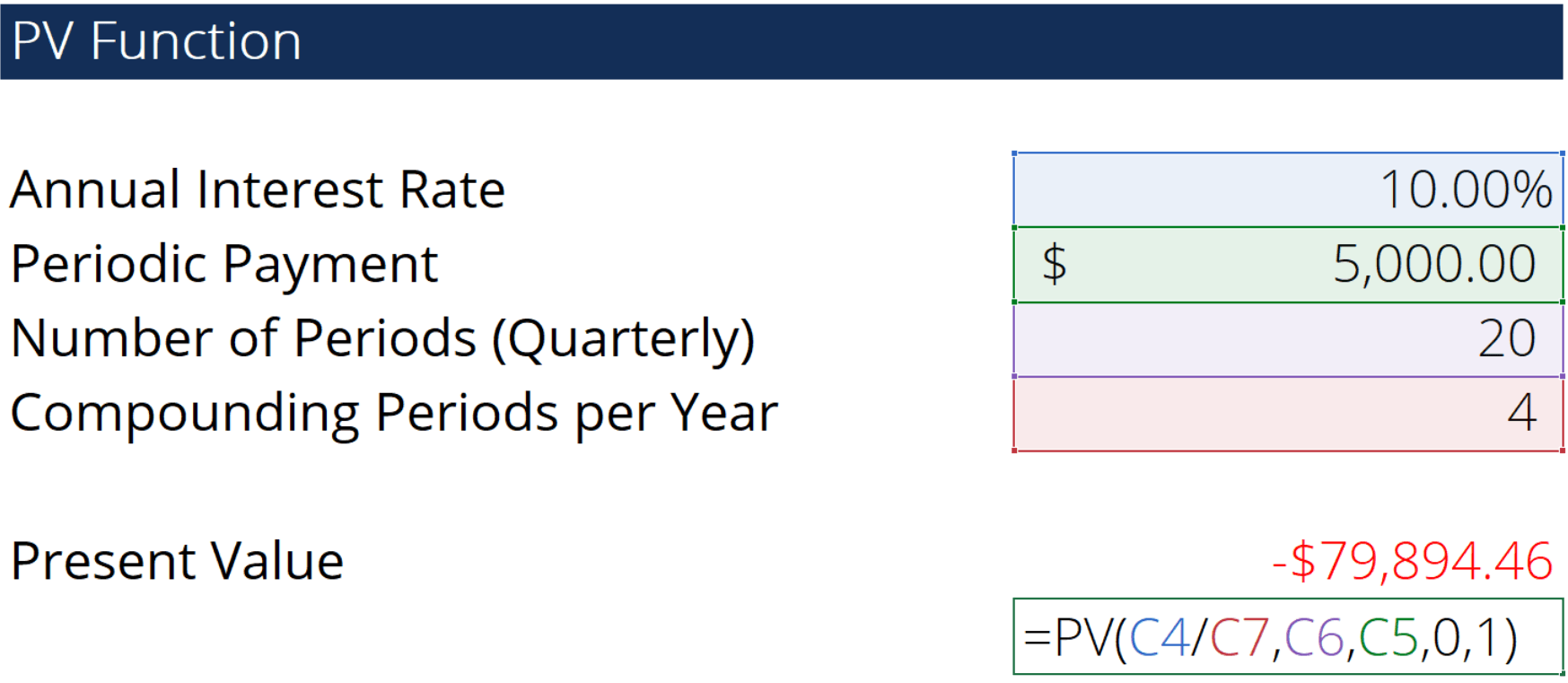

Like the future value calculations in Excel when you are calculating present value to need to ensure that all the time periods are consistent. Calculating the Present Value The PV or Present Value function returns the present value of an investment which is the total amount that a series of future payments is worth presently. For a single cash flow present value PV is calculated with this formula.

You can use the PV function to get the value in todays dollars of a series of future payments assuming periodic constant payments and a constant interest rate. Its app icon resembles a green box with a white X on it. You make an investment of 5000 each month for a period of 3 years at an interest rate of 6 per annum.

In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. Where FV is the future value r is the interest rate and n is the number of periods. Net Present Value NPV is the present value of expected future cash flows minus the initial cost of investment.

Calculate the present value of buying and operating the new vessel. Excel makes calculating present value and a number of other financial formulas easy thanks to its auto feature. Using information from the above example PV 10000.

Its in the upper-left side of the Excel window. This sum equals the present value of a 10-year lease with annual payments of 1000 5 escalations and a rate inherent in the lease of 6 or 9586. 500 Formulas 101 Functions.

Insert the PV function in cell D12. The syntax of the PV function is as follows.

Earned value management EVM is one of several project management techniques you can use to estimate where you are currently in a project versus the projects schedule and budget. Schedule Performance Index SPI EVPV.

Demystifying Earned Value Management Evm

Demystifying Earned Value Management Evm

Within earned value management systems specific terms are used to denote types of budgets and each area of the budget has specific inclusionsexclusions.

Earned value management for dummies. Cost Variance CV Earned Value EV Actual Costs AC It shows your deviation from the planned budget as of now. All of these formulas use EV either subtracting from it or dividing into it. It is a systematic project management process used to find variances in projects based on the comparison of worked performed and work planned.

Get it as soon as Tue Feb 9. Paperback 1890 18. With 76 of IT projects failing Crawford 2002 19 project management and control systems must be utilized to ensure project success.

By Roland Wanner Feb 16 2020. Earned value management for dummies. Cost Variance Earned Value Actual Cost or CV EV AC.

The definition of earned value management for dummies is that EVM is a way to measure project performance on the basis of. Positive shows that you are under your budget. The Earned Value Management System EVMS estab-lishes that baseline to measure progress.

Companies doing business with the government should note that the government is. Earned value is a valuable tool that often is not utilized because it is misunderstood. Earned Value Management is a simple practical concept with significant benefits for project managers including.

Earned Value Management Terms and Formulas for Project Managers The basic premise of earned value management EVM is that the value of a piece of work is equal to the amount of funds budgeted to complete it. Earned Value Management EVM helps project managers to measure project performance. It combines data from scope schedule and resource measurements to assess project performance and progress.

Add this book to your favorite list Community Reviews. Negative means you are overspending. It provides a clear communication of the activities involved and improves project visibility and accountability.

The basic principle of earned value management EVM is that the value of the piece of work is equal to the amount of funds budgeted to complete it. An integrated view of the three key elements of project status planned cost project progress and actual expenditure. Earned Value Management for Dummies book.

Showing 1-4 Average rating 367 Rating details 3 ratings 0 reviews More filters. Cost - Comparing the amount we have spent to the original. Measuring earned value management is an excellent way to track the progress of a project.

Earned Value Management EVM is a technique or a method used to help project managers assess the costs of labor on a project and predict project performance. In this article I have reduced the process of Earned Value Management EVM to a basic 10 step approach to help guide the understanding of those new to the game. Budgets in terms of pounds hours or other measurable units should be allocated to every work package within each control account.

As part of EVM you use the following information to assess your schedule and cost performance throughout your project. Arned value management EVM is simply a set of project management best practices. It lets you know where the project is in regard to cost schedule and work accomplishedknowledge that is critical to the PM and to the success of the project.

Cost Performance Index CPI EVAC. Earned Value Management Fast Start Guide. Be the first to ask a question about Earned Value Management for Dummies Lists with This Book.

This book is designed to introduce EVM concepts to any. The ability to rapidly determine the status of a project based on performance indexes. Earned Value EV has grown in popularity over the years.

Time - Comparing the amount of work which has been done compared to what was scheduled are we going to deliver in. 39 out of 5 stars 5. It compares the planned out roadmap both financial and workflow-related and the actual production progress.

The Most Important Methods and Tools for an Effective Project Control. In reality EVM is decomposed into 32 summary criteria detailing the establishment of an Earned Value Management System EVMS and these 32 criteria contain approximately 200 attributes. EVM is used on the cost and schedule control and can be very useful in project forecasting.

Earned Value Management Formulas Cost Variance. Read reviews from worlds largest community for readers. Negative means behind schedule.

Remember that the variance calculations require that you subtract while the indexes require that you divide. This book is not yet featured on Listopia. Schedule Variance Earned Value Planned Value or SV EV PV.

EVM is a project management methodology not an additional set of tasks to be performed along with the normal project management functions which are to plan execute and assess how the project is performing against the plan. Schedule Variance SV Earned Value EV Planned Value PV This one shows your deviation from schedule.