They are chronological accounting records each one composed of a debit and a credit. Example and Explanation Steps by Step.

Preparing A General Journal For Miscellaneous Transactions Dummies

Preparing A General Journal For Miscellaneous Transactions Dummies

Dummies has always stood for taking on complex concepts and making them easy to understand.

Journal entries for dummies. The process to prepare a journal entry or in other words make a journal entry from scratch is divided into 4 different steps. Steps to Prepare a Journal Entry Journalizing is the process of recording a business transaction in the accounting records Journal Book. Journal Entries Cheat Sheet httpsaccountingstuffcoshopAccounting Basics Lesson 4.

Cash of 4500 is received for the asset and the business makes a gain on disposal of 1500. A Journal Entry is simply a summary of the debits and credits of the transaction entry to the Journal. Although many companies use accounting software nowadays to book journal entries journals were the predominant method of booking entries in the past.

Dummies helps everyone be more knowledgeable and confident in applying what they know. Accounts Receivable Journal Entry Account receivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account. What is the Purpose of Journal Entries.

Whether its to pass that big test qualify for that big promotion or even master that cooking technique. The journal entriesdouble entries above are all the entries required to recognize the IFRS 16 calculations within the accounts of a business that holds a lease. Double-entry accounting is a practice that helps minimize errors and increases the chance that your books balance.

People who rely on dummies rely on it to learn the critical skills and relevant information necessary for. All entries to the General Ledger must be balanced entries. The journal entry may also include a reference number such as a check number.

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period. When doing journal entries we must always consider four factors. Journal entries are how transactions get recorded in your companys books on a daily basis.

Under the defined benefits plan the employee is guaranteed a certain amount of benefitspayments in the future. Because pension payments are usually made much later in the future there is a clear time difference. To learn more launch our online accounting courses now.

Whether its to pass that big test qualify for that big promotion or even master that cooking technique. The purpose of journal entries is to keep a day-to-day chronological record of a business and its transactions. Holtzman Frimette Kass-Shraibman Maire Loughran Vijay S.

Tracy and Jill Gilbert Welytok. Please note that now under IFRS 16 there is no distinction between an operating lease and a finance lease and these should be treated in the same way. Journals or journal entries are simply records of individual transactions in chronological date order.

Journal entries are important because they allow us to sort our transactions into manageable data. This method gets its name because you enter all transactions twice. Dummies helps everyone be more knowledgeable and confident in applying what they know.

This is becaues temporary or nominal accounts also called income statement accounts are measured periodically. Lessee takes an asset under the lease. In this episode of Accounting Basics for Beginners I explain Jour.

Let me outline the journal entries for you. Which accounts are affected by the transaction. Youll notice the above diagram shows the first step as Source Documents.

The fixed assets disposal journal entry would be as follow. Every transaction that gets entered into your general ledger starts with a journal entry that includes the date of the transaction amount affected accounts and description. Dummies has always stood for taking on complex concepts and making them easy to understand.

Payroll Journal Entry Examples In this section of small business accounting payroll we will use a fictitious company to provide examples of journal entries to record gross wages payroll withholding and related payroll costs of a payroll transaction. Thats the cardinal rule of double-entry bookkeeping. In the following General Ledger entry note that the debits and credits are in balance at 2900 each.

Credit Suppliers Bank account Cash whatever is applicable. People who rely on dummies rely on it to learn the critical skills and relevant information necessary for. Accounting ALL-IN-ONE by Ken Boyd Lita Epstein Mark P.

Credit Lease liability in the amount of the lease liability Lessee pays the legal fees for negotiating the contract. When it comes to double-entry bookkeeping the key formula for the balance sheet Assets Liabilities Equity plays a major role. These adjustments are necessary to make final entries for the year and ensure that the companys financial statements are accurate and complete.

In every journal entry that is recorded the debits and credits must be equal to ensure that the accounting equation Assets Liabilities Shareholders Equity remains in balance. Consider the following diagram. And so the amounts in one accounting period should be closed or brought to zero so that they wont get mixed with those of the next period.

A Cash Receipts journal tracks transactions in which the business receives cash. Journal Entry Adjustment in Accounting Practice Questions By Kenneth Boyd Kate Mooney Companies typically adjust journal entries as part of the end-of-period accounting process. Last modified December 13th 2019 by Michael Brown.

The gain of 1500 is a credit to the fixed assets disposals account in the income statement.

Bookkeeping Posting Journal Information To The Appropriate Accounts Dummies

Bookkeeping Posting Journal Information To The Appropriate Accounts Dummies

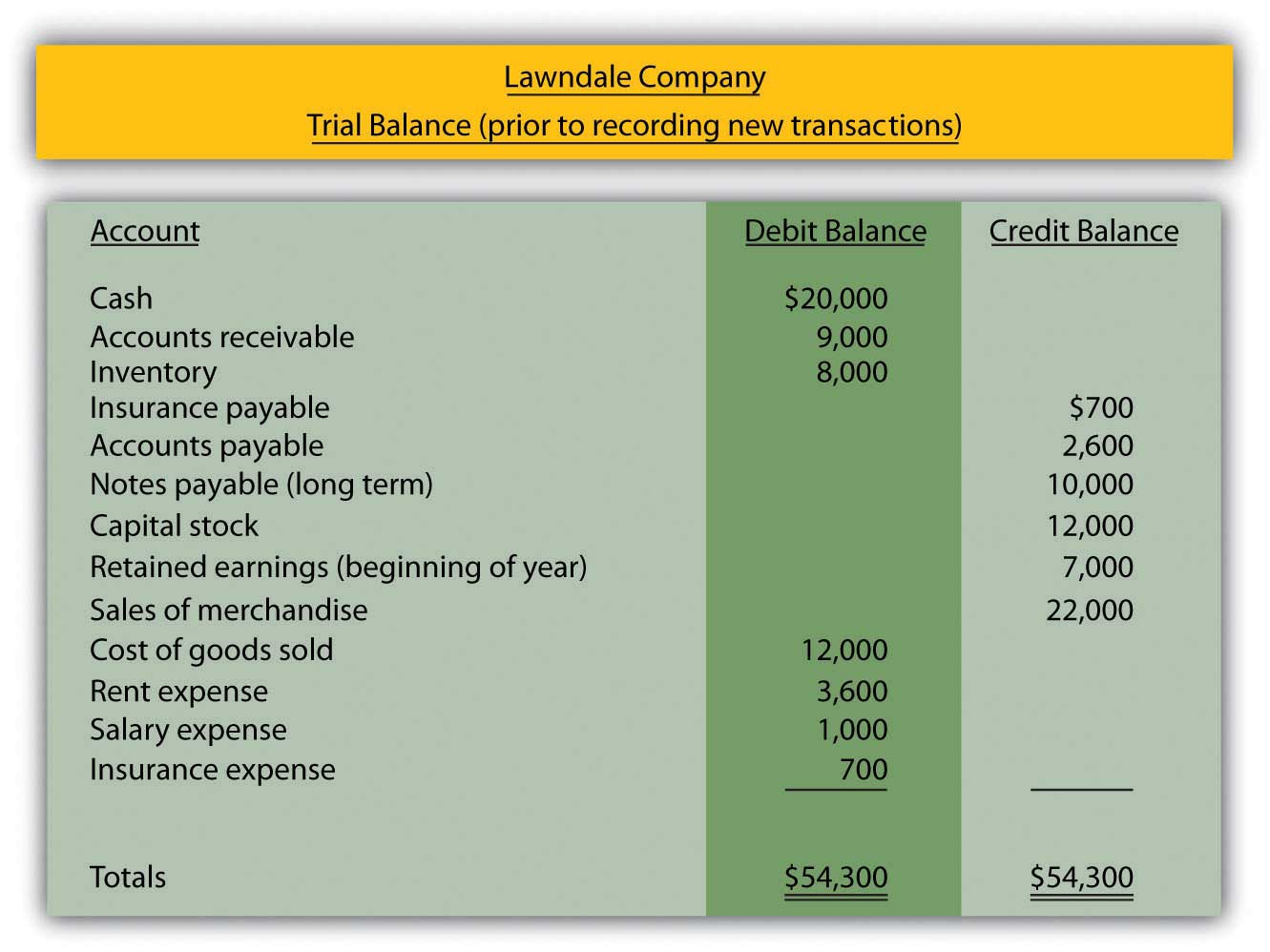

Summarizing Journal Entries To Check For Accuracy Dummies

Summarizing Journal Entries To Check For Accuracy Dummies

Accounting Journal Entry How To Prepare Journal Entries Youtube

Accounting Journal Entry How To Prepare Journal Entries Youtube

Journaling For Dummies Archives The Rocket Software Blog

Journaling For Dummies Archives The Rocket Software Blog

Accounting Journal Entries Examples Bookkeeping And Accounting Accounting Notes Accounting

Accounting Journal Entries Examples Bookkeeping And Accounting Accounting Notes Accounting

Journals For Dummies Part 4 Dspjrn And Journal Entry Types The Rocket Software Blog

Journals For Dummies Part 4 Dspjrn And Journal Entry Types The Rocket Software Blog

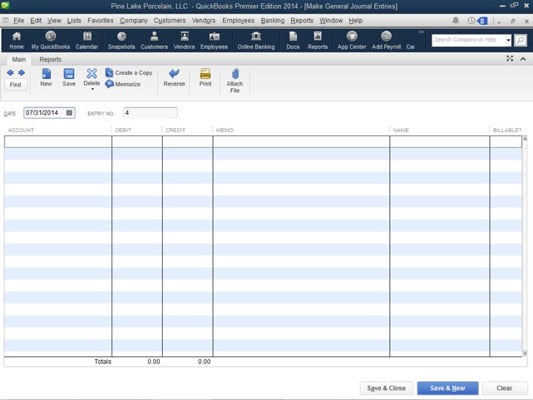

How To Record Quickbooks 2014 Journal Entries Dummies

How To Record Quickbooks 2014 Journal Entries Dummies

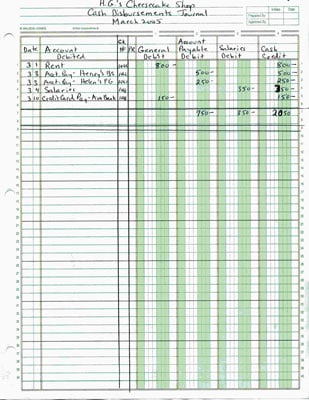

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

How To Develop Entries For The General Ledger Dummies

Understanding Business Accounting For Dummies Cheat Sheet In 2021 Accounting Process Bookkeeping Business Bookkeeping

Understanding Business Accounting For Dummies Cheat Sheet In 2021 Accounting Process Bookkeeping Business Bookkeeping