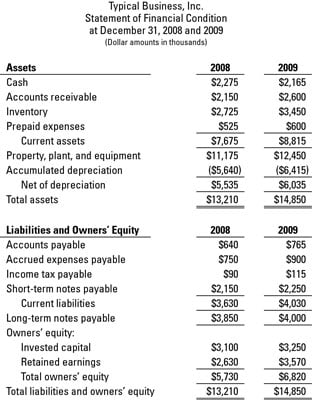

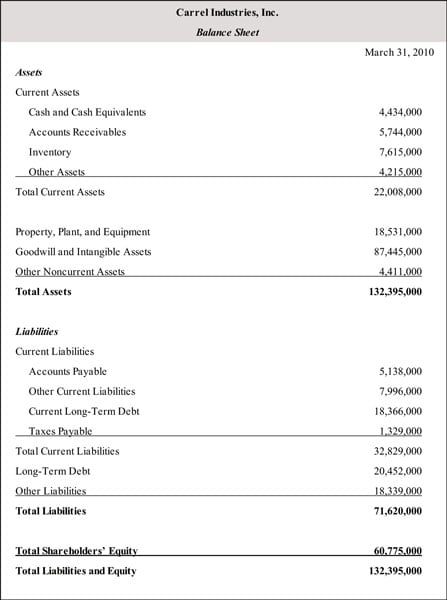

A balance sheet is a snapshot in time. A new sale adds an asset a new member of staff adds a liability and a new share issue adjusts the shareholder equity for example.

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Read A Balance Sheet In 10 Minutes For Dummies

Understanding the benefits of this report are an advantage for business owners when making money decisions.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

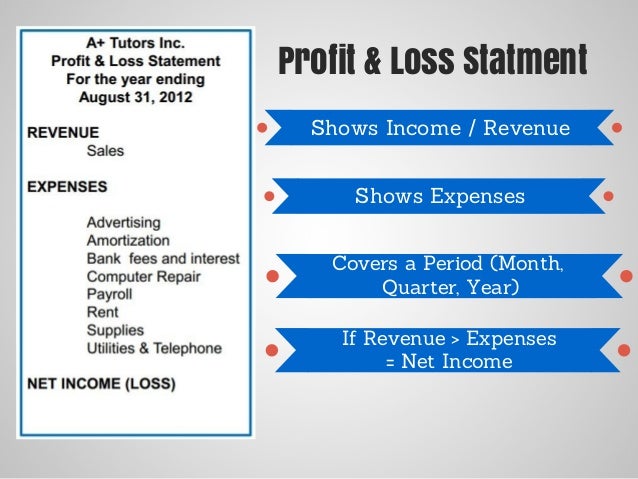

Understanding a balance sheet for dummies. I am so sick of Accountants who make understanding your finances seem complicated. Here are the steps you can follow to create a basic balance sheet for your organization. Balance Sheet along with the Income Statement and the Cash Flow statement forms the three primary financial statements in accounting.

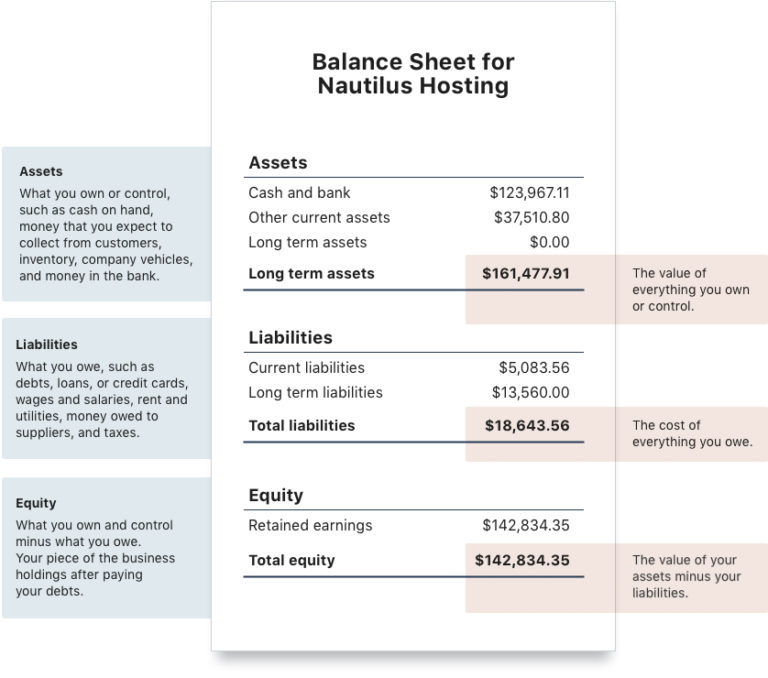

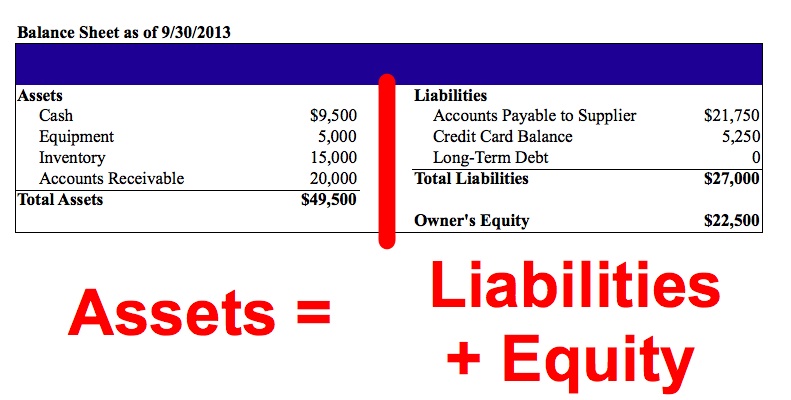

It shows what your business owns assets what it owes liabilities and what money is left over for the owners owners equity. Assets Liabilities Owners Equity. What is a balance sheet and how can I read a balance sheet to learn more about the financial situation of a company.

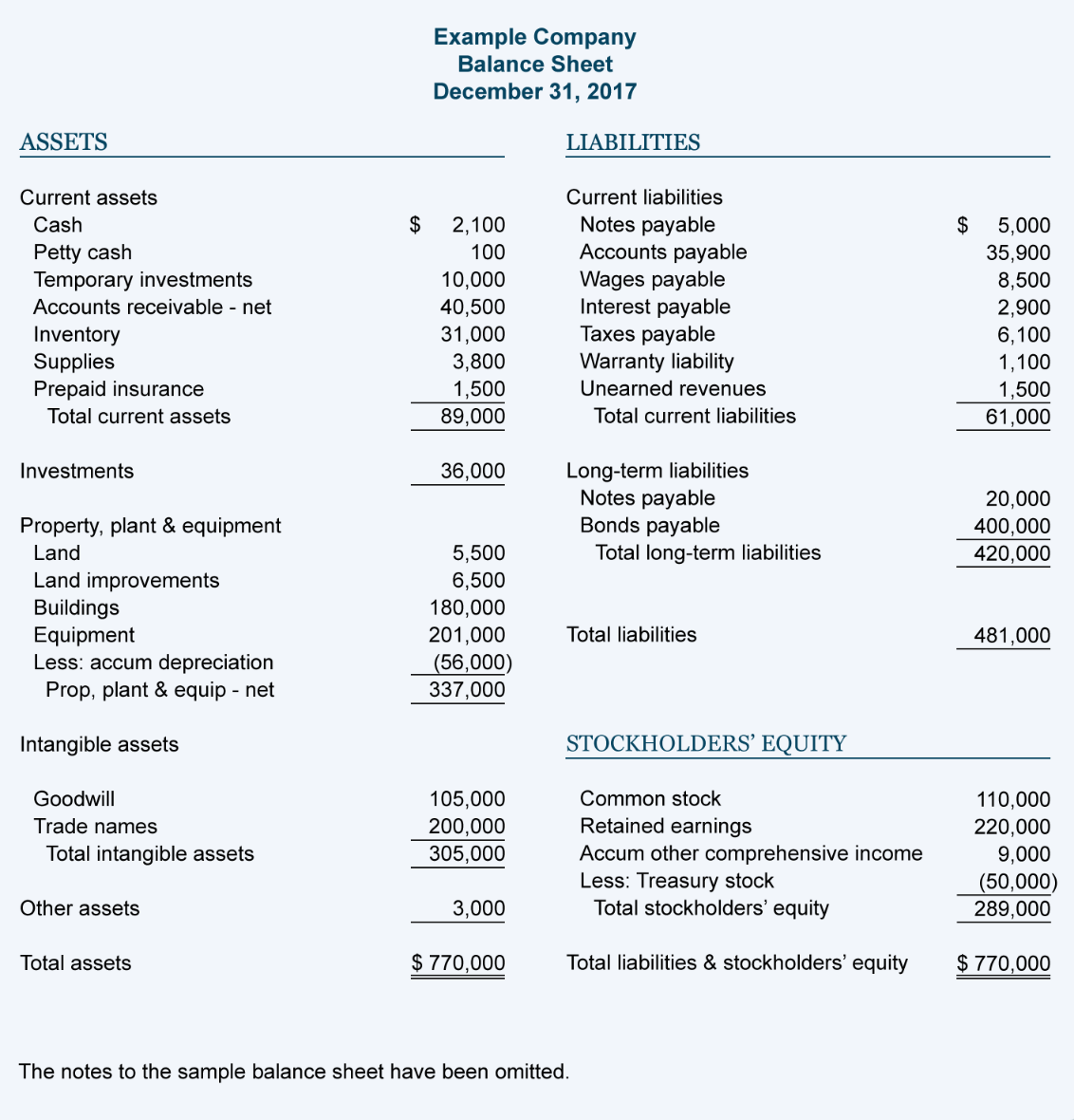

The left or top side of the balance sheet lists everything the company owns. Balance sheets are generally prepared on the end date of a financial year. What do the various financial terms on.

The balance sheet is separated with assets on one side and liabilities and owners equity on the other. How to Prepare a Basic Balance Sheet. It is a detailed document of what a business owns what it owes and who that money belongs to.

The balance sheet is a fundamental or first accounting statement in the sense that every accounting transaction can be analyzed in terms of its dual impact on the balance sheet. The balance sheet together with the income. This one unbreakable balance sheet formula is always always true.

The right side of a balance sheet consists of assets the left side consists of liabilities equity. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worth.

It is like a report card to measure a companys performance. 31st March 2019 or 31st December 2019. Reading a balance sheet.

It is a summary of assets liabilities and equity. Balance Sheet is the most important financial statement as it helps us see the financial position of the company at a given point in time. The balance sheet is one of the more important parts of a companys financial information.

Part 1 of the Accounting for business own. How to Read a Balance Sheet A balance sheet is composed of rows and columns that list a companys assets and liabilities and money owned by shareholders. Accounting is easy.

Using this sheet a person can see what a specific company owns what that company owes and how much shareholders have invested. Balance sheets can be used to calculate a number of useful financial ratios that help to benchmark a business against its competitors and to measure changes in financial. Its assets also known as debits.

Even if some or all of the process is automated through the use of an accounting system or software understanding how a balance sheet is prepared will enable you to spot potential errors so that they can be resolved. Explanation of the balance sheet - its components and what they represent This 5 part series was initially developed to train credit and collection profe. Its essentially a net worth statement for a company.

Being able to read and understand a balance sheet is important for exercising effective financial control of a business and for assessing the financial position of competitors. For a company to survive it has to be able to pay for the things that it owns. Moreover most often revenues and expenses are defined in terms of changes in assets and liabilities.

Accounting Balance Sheet Guide An accounting balance sheet is a financial report providing a quick view of a companys financial condition. The balance sheet presents a financial snapshot of what the company owns and owes at a single point in time typically at the end of each quarter. Hopefully after watching this balance sheet tutorial video you understand how to read a balance sheet.

How to read a balance sheet A balance sheet is only a snapshot in time and constantly changes as the elements that make up the balance sheet are in regular movement. 1 One column lists the category of assets and liabilities and one lists the total amount for each of those categories. It may even have two years worth of information.

A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched. A balance sheet is a snapshot of a businesss financial position on any given day. Therefore a balance sheet is also known as a summarised statement of assets liabilities and equity.

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Read A Balance Sheet In 10 Minutes For Dummies

Balance Sheet For Dummies Youtube

Balance Sheet For Dummies Youtube

How To Read A Balance Sheet Understanding Financial Statements

How To Read A Balance Sheet Understanding Financial Statements

How To Read A Business Balance Sheet Dummies

How To Read A Business Balance Sheet Dummies

How To Read A Balance Sheet The Non Boring Version

How To Read A Balance Sheet The Non Boring Version

Understanding Financial Statements For Beginners

Understanding Financial Statements For Beginners

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Read A Balance Sheet In 10 Minutes For Dummies

How To Understand Your Accounting Balance Sheet

How To Understand Your Accounting Balance Sheet

How To Read A Company S Balance Sheet Dummies

How To Read A Company S Balance Sheet Dummies