APR stands for Annual Percentage Rate. APR stands for the Annual Percentage Rate and its the official rate used for borrowing.

Interest Rates Aer And Apr Explained Moneysavingexpert

Interest Rates Aer And Apr Explained Moneysavingexpert

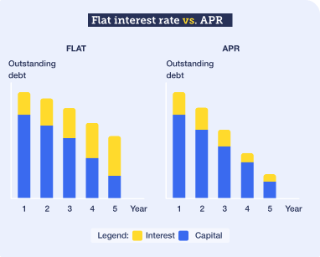

APR is an annualized representation of your interest rate.

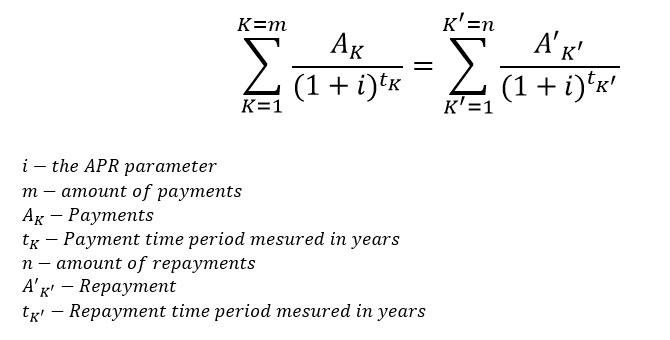

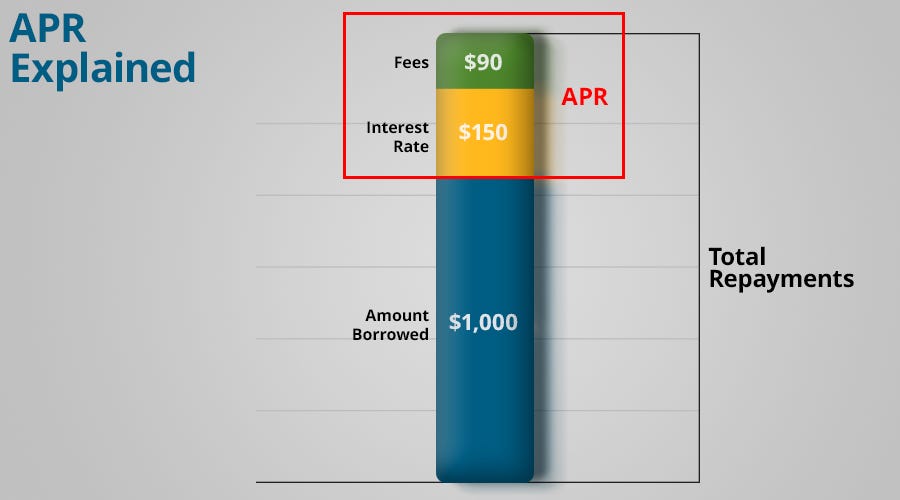

Apr explained for dummies. APRs can be calculated as simple or compound interest and rates can be fixed or variable. APR or annual percentage rate is the interest rate you pay on a loansuch as a credit card or auto loanon a yearly basis. The Annual Percentage Rate APR is designed to be a benchmark for consumers providing an annual summary of the cost of credit.

Dummies helps everyone be more knowledgeable and confident in applying what they know. As well as the interest the APR also takes into account any compulsory charges like an annual fee if there is one. When its calculated it has to include.

APR refers to the Annual Percentage Rate and is the universal measure for comparing the price all financial products such as loans credit cards and mortgages. Presented as a percentage APR is a calculation of the full amount you will pay for a loan over the course of one year. Understanding APR and how it effects a loan is one of the ways that will help you save money.

The term annual percentage rate APR refers to the annual rate of interest charged to borrowers and paid to investors. In this HowStuffWorks article well help you understand why interest rates exist how theyre calculated and why they change over time. This guide will talk you through exactly what is meant by the term APR and it will tell you everything that you need to know about it.

In simple terms its the cost of borrowing the money. Dummies has always stood for taking on complex concepts and making them easy to understand. High interest rates can be deceptively expensive.

Whether its to pass that big test qualify for that big promotion or even master that cooking technique. The biggest cost is usually one-time fees called points The bank calculates them as a percentage point of the total loan. For individuals looking to compare different loans and credit products they can simply look at the APR to get an idea of how much it will cost and make an informed decision.

The loan is secured against the value of your home until its paid off. Many loans last longer than one year. Credit Card Insider receives compensation from advertisers whose products may be mentioned on this page.

The annual percentage rate APR of a mortgage is a rate that you can use to help you analyze the mortgage and determine whether the terms of the loan make it attractive. How its applied and how its calculated. It includes interest rates plus other costs.

Your APR is shown as a percentage and includes fees and costs related to the loan. APR is a three letter acronym that stands for annual percentage rate. Well also explain what the Federal Reserve is what it has to do with interest rates and why the Federal Reserve chairman is the most closely watched economist in the world.

The world of finance is packed with so many terms and phrases that it can sometimes be a bit overwhelming. When you borrow money your lender will often advertise an APR Annual Percentage Rate. APR which stands for annual percentage rate is the yearly cost of borrowing money.

APR is the interest rate in addition to fees and charges over a whole year as opposed to monthly interest rates. The APR of a mortgage. If you borrow 1000 for a year at a 20 APR the total to pay back would be 1200.

Its helpful to consider two main things about how APR works. People who rely on dummies rely on it to learn the critical skills and relevant information necessary for success. If you cant keep up your repayments the lender can repossess take back your home and sell it so they get their money back.

Most run for 25 years but the term can be shorter or longer. Very simply APR is a comparative measure to help understand different loans. The annual percentage rate APR is the total cost of the loan.

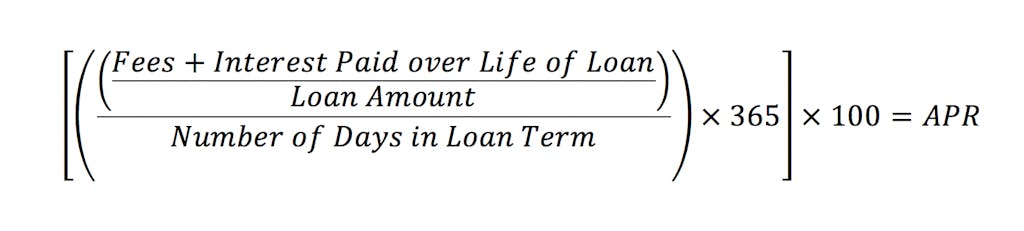

The cost of the borrowing so the amount of interest charged. APR is expressed as a percentage that represents the actual yearly cost of. Heres how you can calculate the true cost of your APR.

When deciding between credit cards APR can help you compare how expensive a transaction will be on each one. The calculation includes any fees you may need to pay plus the interest rate a lender applies to your particular loan. APR stands for annual percentage rate which refers to the interest youre being charged to borrow money.

A mortgage is a loan taken out to buy property or land. This is slightly different from the interest rate because it is made up of the interest rate plus any fees that are automatically included in your loan for example any arrangement fees. Credit Card APR Explained The single most important number related to your credit card account is the Annual Percentage Rate which is the interest you pay on your accrued balance.

Apr Formula Explained By Cashfloat

Apr Formula Explained By Cashfloat

Academic Progress Rate Explained Ncaa Org The Official Site Of The Ncaa

Academic Progress Rate Explained Ncaa Org The Official Site Of The Ncaa

Annual Percentage Rate Wikipedia

Annual Percentage Rate Wikipedia

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr Understanding How Apr Is Calculated Apr Types

Apy Vs Apr And Interest Rates What S The Difference Ally

Apy Vs Apr And Interest Rates What S The Difference Ally

What Does Apr Mean Apr Explained Go Car Credit

What Does Apr Mean Apr Explained Go Car Credit

What Is Apr Understanding Exactly How Apr Works

What Is Apr Understanding Exactly How Apr Works

What Is Apr Understanding Exactly How Apr Works

What Is Apr Understanding Exactly How Apr Works

Apr Vs Interest Rates What S The Difference By Flexfi Online Personal Loans Medium

Apr Vs Interest Rates What S The Difference By Flexfi Online Personal Loans Medium

What Is Apr And Why Is It Important Credit Karma

What Is Apr And Why Is It Important Credit Karma

Apy Vs Apr And Interest Rates What S The Difference Ally

Apy Vs Apr And Interest Rates What S The Difference Ally

Mortgage What Is Apr Wells Fargo

Mortgage What Is Apr Wells Fargo

Annual Percentage Rate What Is Apr Zing Blog By Quicken Loans

Annual Percentage Rate What Is Apr Zing Blog By Quicken Loans