The income tax return is an official statement which shows your total income earned from all sources your tax deductions under various headers of the Income Tax Act and your final tax liability. Youll also list your business expenses and gains in this form.

Self Employed Taxes For Dummies Everything You Need To Know About Filing Scrubbed

Self Employed Taxes For Dummies Everything You Need To Know About Filing Scrubbed

The deadline for paper.

Filing taxes for dummies. Whether its to pass that big test qualify for that big promotion or even master that cooking technique. For singles or independents you must file if you make more than 12200 per year. Those married filing jointly only have to file if making more than 24400 per year.

If your net earnings from self-employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions PDF. Social Security tax comprises 124 of your net earnings and Medicaid 29. Head on over to the governments income tax e-filing website click here and follow the instructions to register yourself.

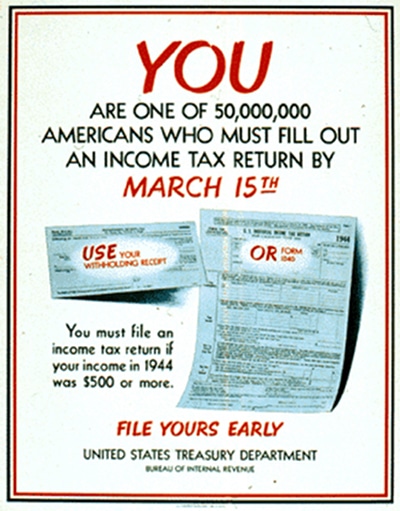

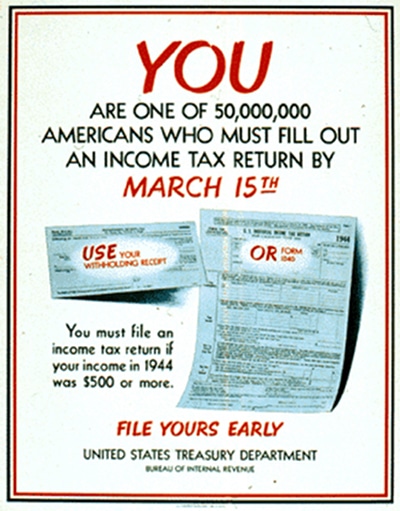

To file a federal income tax return for an estate youll need Form 1041 the US. Take note that Social Security taxes are capped at a certain amount each year. Paying Taxes on Time to Avoid Penalties April 15 is the deadline for filing state and federal individual income tax returns.

You have to file an income tax return if your net earnings from self-employment were 400 or more. A tax return is a form on which you report details of your taxable income. The IRS issues more than 9 out of 10 refunds in less than 21 days.

These 14 tax tutorials will guide you through the basics of tax preparation giving you the background you need to electronically file your tax return. Fastest tax refund with e-file and direct deposit. Prices are subject to change without notice.

You can claim back the tax or VAT on certain business expenses. Free Tax Filing Options If you meet certain guidelines you can use some popular tax programs for free. Youll use Form 1120 US Corporation Income Tax Return to calculate and pay federal income tax for your business.

A 40 Refund Processing Service fee applies to this payment method. Common Tax Filing Mistakes Dont let your refund be delayed by making one of these common mistakes. To understand filing of income tax returns there are some common terms you must understand.

Need hints on completing a Form W-4. You can obtain a list of publications produced by the IRS by calling 1-800-829-3676. However tax returns also work in the opposite way.

Making Tax Digital is a key part of the governments plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs. Unmarried or married filing separately living in the US. Maru explains what to do next.

This applies to things like mileage allowances specialist clothing or equipment subscription to professional bodies or household expenses if you work from home. As a general rule file a return if your total income was more than the value of your standard deduction which was 12400 for an individual in 2020 and 12550 for an individual in 2021. Income thresholds for filing 2020 taxes.

Pay for TurboTax out of your federal refund. How to Choose a Tax Preparer Know how to find a qualified professional and be aware of common tax scams. Monday April 15 2021 is when your.

You may be asked to download an ITR return preparation software. HMRC uses the information you provide to work out your tax bill or whether you are due a refund. Ways to Save Money on Taxes Find out what you can do throughout.

The table below lists the filing thresholds for most people in 2020. People who rely on dummies rely on it to learn the critical skills and relevant information necessary for. You should file Form 8938 if your aggregate foreign holdings are worth 50000 or more on the last day of the tax year or were more than 75000 at any time during the tax year.

Once youve registered click on the income tax returns tab to see the forms available for e-filing. If youre not a PAYE taxpayer you need to declare your last years income and pay the right amount of income tax. Anyone who is 18 or over and makes more than a certain amount according to their filing status must file taxes.

Typically Tax Day is April 15 meaning thats the last day to e-file or mail your tax return. Dummies has always stood for taking on complex concepts and making them easy to understand. Income Tax Return for Estates and Trusts.

Married filing jointly and living in the US. For starters check out the tax tutorials to find the answers to these frequently asked questions. They have many publications such as Your Federal Income Tax and Tax Guide for Small Business.

When you are self-employed you are liable for the full 153 tax rate on your net earnings. Dummies helps everyone be more knowledgeable and confident in applying what they know. Or check your local public library which probably has a reference set of IRS publications updated annually for the tax filing season.

Typically youll want to download the fillable PDF of this form available on the IRS website. Tax refund time frames will vary. Its important to note that corporations are double-taxed first at the business level and then at each owners personal income level.

There are deadlines for filing your taxes that you must meet. You should file Form 8938 if your foreign holdings are worth 100000 or more on the last day of the tax year or were more than 150000 at any time during the tax year. Simply put the purpose of a tax return is to make sure everybody has paid the right amount of tax.

This is made up of two parts Social Security and Medicaid.

Tax For Dummies Amazon Co Uk Laing Sarah 9780470998113 Books

Tax For Dummies Amazon Co Uk Laing Sarah 9780470998113 Books

How To File Taxes Small Business Taxes For Dummies Wisestamp

How To File Taxes Small Business Taxes For Dummies Wisestamp

How To File Your Own Taxes A Beginner S Guide Benzinga

How To File Your Own Taxes A Beginner S Guide Benzinga

Tax For Dummies Amazon Co Uk Laing Sarah 9780470998113 Books

Tax For Dummies Amazon Co Uk Laing Sarah 9780470998113 Books

Taxes Taxes For Beginners The Easy Guide To Understanding Taxes Tips Tricks To Save Money Amazon Co Uk Sullivan James 9781534621725 Books

Taxes Taxes For Beginners The Easy Guide To Understanding Taxes Tips Tricks To Save Money Amazon Co Uk Sullivan James 9781534621725 Books

How To Do Your Taxes For Beginners The Art Of Manliness

How To Do Your Taxes For Beginners The Art Of Manliness

Bookkeeping All In One For Dummies Amazon Co Uk Consumer Dummies 9781119094210 Books

Bookkeeping All In One For Dummies Amazon Co Uk Consumer Dummies 9781119094210 Books

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books

Small Business Taxes For Dummies By Eric Tyson Waterstones

Small Business Taxes For Dummies By Eric Tyson Waterstones

Tax Tips For Canadians For Dummies 2006 By Christie Henderson

Tax Tips For Canadians For Dummies 2006 By Christie Henderson

Taxes For Dummies 2004 Amazon Co Uk Tyson Eric Silverman Ea David J 9780764541179 Books

Taxes For Dummies 2004 Amazon Co Uk Tyson Eric Silverman Ea David J 9780764541179 Books

Taxes For Dummies Book By Eric Tyson

Taxes For Dummies Book By Eric Tyson

Taxes For Dummies 2007 Amazon Co Uk Tyson Eric Munro Ea Margaret A Silverman Ea David J 9780470079010 Books

Taxes For Dummies 2007 Amazon Co Uk Tyson Eric Munro Ea Margaret A Silverman Ea David J 9780470079010 Books

1998 Edition Taxes For Dummies Amazon Co Uk Eric 9780764550690 Books

1998 Edition Taxes For Dummies Amazon Co Uk Eric 9780764550690 Books