Would you trade 15955 for 100 right now. Calculate your paper price.

How To Use The Excel Pv Function Exceljet

How To Use The Excel Pv Function Exceljet

Show detailed computations in your Excel spreadsheet.

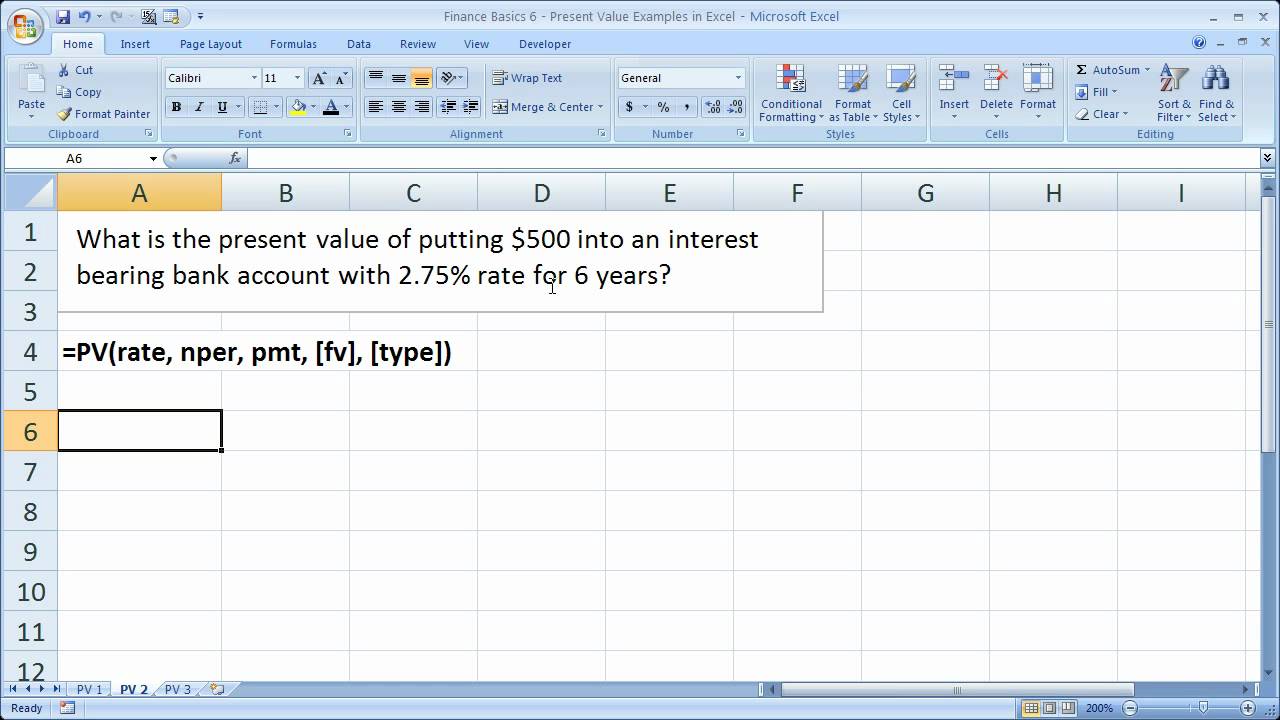

Calculating present value in excel. PV ratenperpmt fv type. In this tutorial you will learn to calculate Net Present Value or NPV in ExcelIn this tutorial you will learn to calculate Net Present Value or NPV in. Show detailed computations in your Excel spreadsheet.

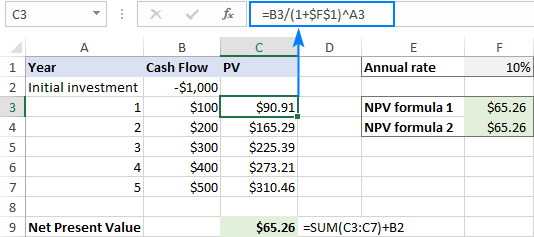

First we calculate the present value pv of each cash flow. To better understand the idea lets dig a little deeper into the math. Dont use plagiarized sources.

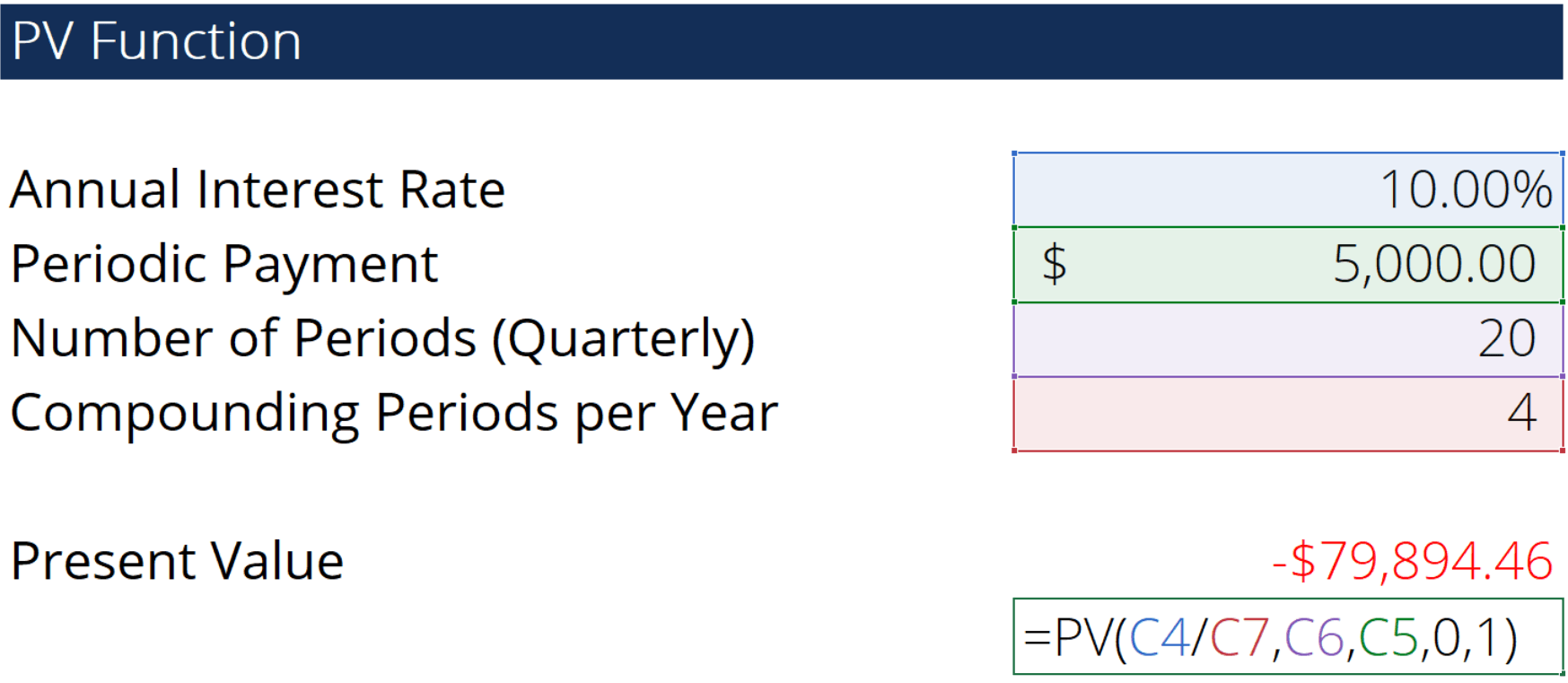

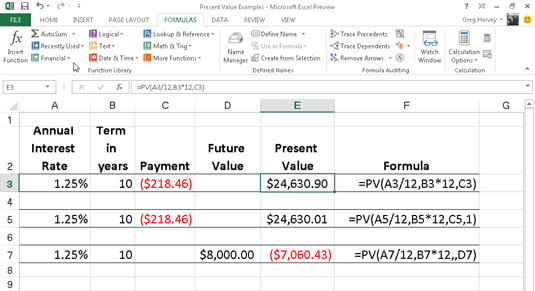

The syntax for present value in excel is. Present Value 96154 92456 88900 85480 Present Value 362990 Therefore the present day value of Johns lottery winning is 362990. This means that you will need to divide the annual interest rate by the number of compounding periods in the year.

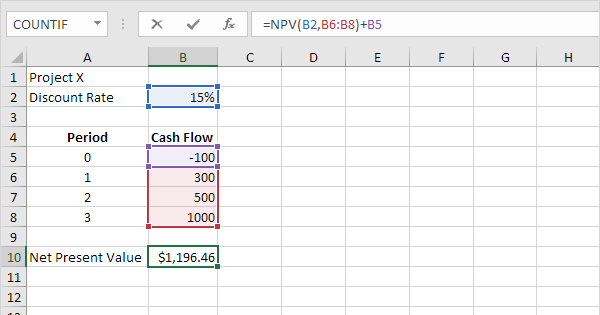

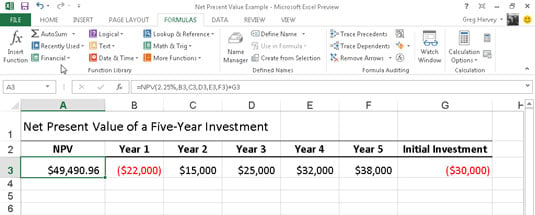

Present Value for all the year is calculated as. The Excel function to calculate the NPV is NPV. The formula for present value is PV FV 1rn.

To calculate NPV you need to know the annual discount. NPV discount rate series of cash flow. The Excel PV function is a financial function that returns the present value of an investment.

50 in 2 years is worth 3781 right now. The NPV or Net Present Value is the present value or actual value of a future flow of funds. Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column.

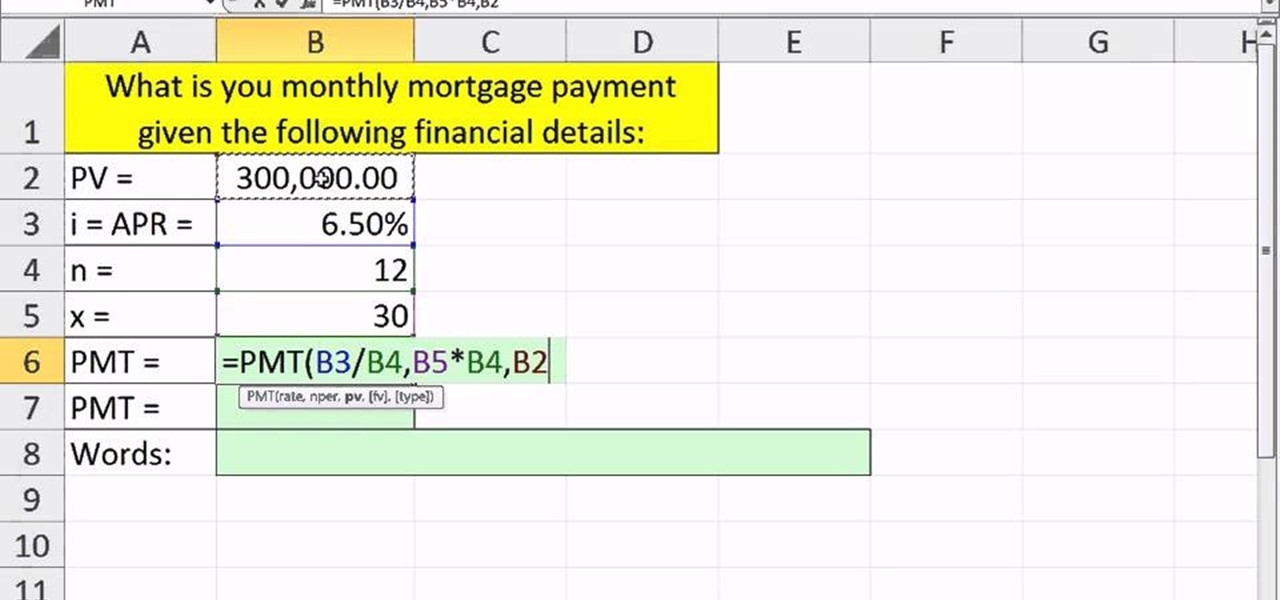

Pmt is the regular payment per period if omitted this is set to the default. Make sure that you have the investment information available. The NPV function in Excel only calculates the present value of uneven cashflows so the initial cost must.

Nper is the number of periods over which the investment is made. Present Value 1 0 5 1 5 1 1 0 0 beginaligned textPresent Value frac 105 1 5 1 100 endaligned Present Value 1 5 1 1 0 5 1 0 0. Using the Excel PV Function to Calculate the Present Value of a Single Cash Flow.

Rate is the interest rate per period as a decimal or a percentage. 25 in 1 year is worth 2174 right now. To know the current value you must use a discount rate.

Next we sum these values. NPV PV of future cash flows Initial Investment. Most financial analysts never calculate the net present value by hand nor with a calculator instead they use Excel.

Present Value Function Syntax. 15209 in 3 years is worth 100 right now. The present value of a future cash flow is the current worth of it.

Using Excel as a Time Value of Money Calculator calculate the present value of your investment. The auto feature automatically calculates various functions and recalculates every time a value formula or name is changed. Get Your Custom Essay on.

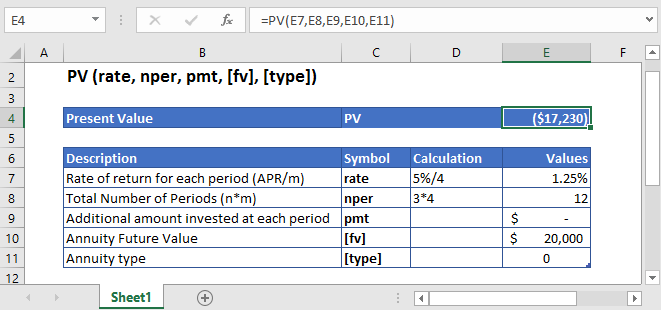

Like the future value calculations in Excel when you are calculating present value to need to ensure that all the time periods are consistent. Calculating the Present Value The PV or Present Value function returns the present value of an investment which is the total amount that a series of future payments is worth presently. For a single cash flow present value PV is calculated with this formula.

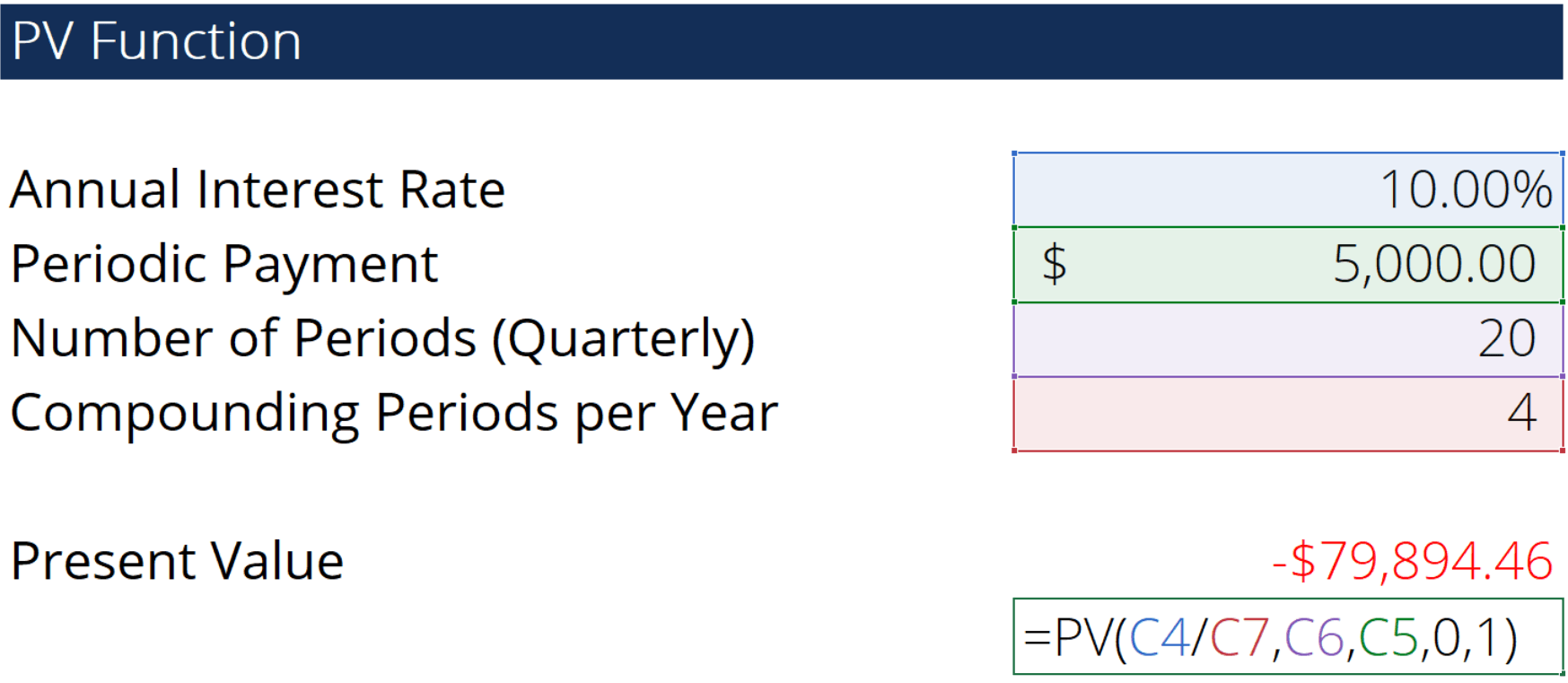

You can use the PV function to get the value in todays dollars of a series of future payments assuming periodic constant payments and a constant interest rate. Its app icon resembles a green box with a white X on it. You make an investment of 5000 each month for a period of 3 years at an interest rate of 6 per annum.

In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. Where FV is the future value r is the interest rate and n is the number of periods. Net Present Value NPV is the present value of expected future cash flows minus the initial cost of investment.

Calculate the present value of buying and operating the new vessel. Excel makes calculating present value and a number of other financial formulas easy thanks to its auto feature. Using information from the above example PV 10000.

Its in the upper-left side of the Excel window. This sum equals the present value of a 10-year lease with annual payments of 1000 5 escalations and a rate inherent in the lease of 6 or 9586. 500 Formulas 101 Functions.

Insert the PV function in cell D12. The syntax of the PV function is as follows.

Calculate Npv In Excel Net Present Value Formula

Calculate Npv In Excel Net Present Value Formula

How To Calculate The Present Value Of An Annuity With Excel S Pmt Function Microsoft Office Wonderhowto

How To Calculate The Present Value Of An Annuity With Excel S Pmt Function Microsoft Office Wonderhowto

What Is The Formula For Calculating Net Present Value Npv In Excel

How To Calculate Pv Of A Different Bond Type With Excel

Finance Basics 6 Present Value Examples In Excel How Much Something Is Worth Today Youtube

Finance Basics 6 Present Value Examples In Excel How Much Something Is Worth Today Youtube

How To Calculate The Present Value In Excel 2013 Dummies

How To Calculate The Present Value In Excel 2013 Dummies

Excel Formula Present Value Of Annuity Exceljet

Excel Formula Present Value Of Annuity Exceljet

Pv Function Formula Examples How To Use Pv In Excel

Pv Function Formula Examples How To Use Pv In Excel

How To Calculate The Net Present Value In Excel 2013 Dummies

How To Calculate The Net Present Value In Excel 2013 Dummies

Pv Function Present Value In Excel Vba Google Sheets Automate Excel

Pv Function Present Value In Excel Vba Google Sheets Automate Excel

How To Use The Excel Pv Function Exceljet

How To Use The Excel Pv Function Exceljet

How To Calculate Net Present Value Npv In Excel Youtube

How To Calculate Net Present Value Npv In Excel Youtube