Double-entry bookkeeping is the process that most businesses use to produce their accounts. Double entry bookkeeping is where the value from every business.

What Is Single Entry And Double Entry Bookkeeping

What Is the Double Entry Concept in Accounting.

How to do double entry bookkeeping. How double-entry accounting works Step 1. Every business transaction has to be recorded in at least two accounts in the books. Use debits and credits for all transactions.

A simple example is that is a sales invoice is issued. Debits are on the left side of the accounting entry and credits are on the right side. A daybook is a descriptive and chronological.

Double entry bookkeeping is a system of bookkeeping which records each transaction twice. Set up a chart of accounts. Double-entry bookkeeping says each accounting transaction has two sides.

Double-entry accounting refers to the system of commercial bookkeeping where all of a companys business transactions are systematically listed. The general ledger is the record of the two sides of each transaction. The annual account balance or in other words the consolidation of all business transactions within one fiscal year has to be filed with the IRS HMRC at the end of the tax year.

A quick heads up about double-entry bookkeeping. Double Entry Bookkeeping 7 Step Guide to Processing Business Accounts. Every time money enters or leaves your business its recorded once as a positive income or negative expense value.

If a company takes out a loan for example its cash account will increase with the funds from that loan but its liability account will also increase under the account category known as loans payable. In double entry bookkeeping for every debit there must be a credit so when the basic accounting journal entries are complete the total of all the debits must equal the total of all the credits. In 1494 Luca Pacioli a monk and mathematician was the first to publish a treatise Summa de arithmetica which included details of double entry bookkeeping.

There will be an entry in the sales profit and Loss Account and customer account increased Debtors. Single-entry bookkeeping is a good choice if you run a small simple business with a low volume of transactions. The information from the documents.

Why do we need Journal Entries. Using a Journal to record each journal entry has many advantages. The first entry is debit in one account and the second entry is a credit in another account.

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts. For each transaction the total debits recorded must equal the total credits recorded. Business transactions produce documents.

The aim for which is to balance the total credit and debit for having a consistent accounting experience. If a transaction takes place then two entries need to be made. The general ledger is a record of the two sides of.

While you can certainly create a chart of accounts manually accounting software. The basic steps of double entry bookkeeping. The system was first developed in the 13th century and used by Italian merchants.

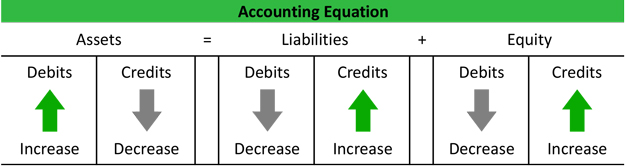

When it comes to double-entry bookkeeping the key formula for the balance sheet Assets Liabilities Equity plays a major role. In order to adjust the balance of accounts in the bookkeeping world you use a combination of debits and credits. You do not have to use T accounts but they are an aid to working out what the accounting entries are before producing a journal entry.

To get a sense for it you need to understand a little about. This method gets its name because you enter all transactions twice. But what does that mean on a practical level.

The double-entry method of bookkeeping is standard for larger. How business accounts are structured. How to do double-entry bookkeeping Double-entry bookkeeping aims to track all the knock-on effects of a business transaction and reflect them in your business accounts.

This method is often misunderstood so its essential to understand these ground rules. At the core of double-entry bookkeeping is the concept that every transaction will involve at least two accounts if not more. It provides an ongoing record of typical transactions.

The T accounts themselves are not part of the double entry bookkeeping system and are not used to maintain the bookkeeping records of a business. Double entry accounting refers to accounting where a single entry is recorded in two or more ways. A debit is always on the left side of the ledger while a credit is.

A debit and a credit. A trial balance shows if the. Double-entry bookkeeping uses a system of debits and credits to post accounting transactions and keep the balance sheet equation equal.

Total assets must always equal total liabilities plus equity net worth or.

What Is Double Entry Accounting Bookkeeping Example Explanation

Opening Entry In Accounting Double Entry Bookkeeping

Double Entry System Of Bookkeeping Meaning Advantages Disadvantages

Double Entry Accounting Accounting Basics Accounting Student Learn Accounting

Double Entry Accounting Explained Simply And Briefly Ionos

Double Entry Accounting Type Of Accounting Zoho Books

Bookkeeping Double Entry Debits And Credits Accountingcoach

Double Entry Bookkeeping System Accounting For Managers

What Is Double Entry Accounting Quickbooks Canada

Double Entry System Asia Bookkeeping

What Is Double Entry Bookkeeping Accounts On Call Bookkeeping Accounting Auckland New Zealand

A Tutorial Doubleentryaccounting Org On Double Entry Bookkeeping And Accounting Youtube

Free Online Bookkeeping Course 7 Double Entry Bookkeeping System Youtube

ads

Slide Course

Search This Blog

Labels

- 1041

- 11th

- 12th

- 16th

- 2007

- 2010

- 2013

- 401k

- 75th

- 85th

- abbreviations

- abreviation

- acceleration

- account

- accounting

- accounts

- action

- activate

- active

- actual

- adding

- additional

- address

- adhesion

- adjectives

- administration

- adobe

- advisor

- aerate

- aero

- agent

- algebra

- alive

- always

- amendment

- amendments

- amps

- analysis

- anatomical

- android

- angle

- angles

- angular

- animate

- another

- anti

- anyone

- aperture

- apple

- archaea

- area

- aristotle

- armed

- armor

- artistic

- asvab

- asymptotes

- atah

- atoms

- audio

- australia

- autobiography

- autofill

- autosum

- average

- bacardi

- back

- backup

- bacteria

- bags

- balance

- banging

- baptism

- baruch

- basic

- basics

- basket

- basketball

- bass

- battery

- beans

- beds

- beef

- beer

- beginners

- being

- beliefs

- belly

- beneficiaries

- best

- betting

- between

- bidder

- bidding

- billing

- binomial

- binomials

- biogeography

- biology

- bisector

- blend

- blood

- bobbers

- boil

- bonds

- book

- bookkeeping

- borax

- borrow

- brake

- breaker

- bridge

- browsing

- build

- burn

- business

- buttocks

- button

- buying

- cables

- calculate

- calculating

- calculator

- calculus

- call

- called

- camera

- canon

- capitalized

- card

- cards

- care

- careers

- cash

- caste

- categorical

- catholic

- caulk

- caused

- causes

- centripetal

- centroid

- chalk

- change

- chart

- charts

- cheat

- check

- chemical

- chemistry

- chess

- chickens

- chord

- chords

- chromebook

- church

- circle

- circles

- circuit

- circular

- circulatory

- circumference

- class

- classical

- clean

- cleanup

- clicking

- clone

- clothes

- cloud

- club

- clubs

- coastal

- coding

- coefficients

- cogs

- cohesion

- cold

- college

- columns

- command

- commandments

- commas

- comments

- commodities

- common

- commons

- communication

- company

- compatible

- competitive

- complementary

- compost

- compute

- computer

- concrete

- conditional

- conditioning

- conduction

- conf

- confidence

- confirmation

- congruence

- congruent

- conjugating

- connect

- connecting

- connection

- cons

- constant

- constitution

- contacts

- continuous

- continuum

- contribution

- control

- controls

- convert

- cooker

- cookies

- cooking

- copper

- corinthian

- cornstarch

- cost

- costing

- cover

- craft

- crafting

- create

- critical

- crochet

- crop

- crossfit

- cubic

- current

- curtain

- curve

- cycle

- d3100

- d7000

- d7100

- data

- days

- decimal

- decimals

- decrease

- default

- define

- definition

- defrag

- defragment

- defragmenter

- degree

- delete

- deleting

- demand

- dent

- depreciation

- depression

- derivative

- derivatives

- descriptive

- design

- desktop

- deviation

- deviations

- diabetes

- diagonals

- diagram

- diamond

- diesel

- diet

- difference

- different

- differential

- dimmer

- direct

- directory

- disable

- disk

- displacement

- disposal

- distances

- distributing

- distribution

- division

- document

- does

- dogs

- domo

- down

- download

- dragon

- drainage

- drinks

- drywall

- dummies

- dural

- dutch

- earned

- earnings

- east

- eastern

- easy

- ebay

- economic

- economics

- edges

- effusion

- eggs

- elasticity

- electronics

- elements

- eleventh

- embryology

- empty

- ending

- endings

- endosymbiosis

- energy

- engine

- entries

- entry

- equation

- equations

- equilibrium

- equivalent

- estate

- ethernet

- euthanize

- evolution

- example

- examples

- excel

- exchange

- exercises

- expense

- explained

- explorer

- exponential

- exponents

- facetime

- factorial

- factory

- families

- fantasy

- fatter

- feather

- federal

- feeding

- fence

- fertilize

- fiction

- fifths

- fight

- fighting

- file

- filing

- fill

- final

- financial

- find

- fire

- first

- fish

- fishermans

- fishing

- fixed

- fixing

- flash

- flipping

- floating

- floor

- floors

- florida

- flow

- flower

- fluid

- food

- football

- footnote

- footnotes

- force

- forces

- form

- format

- formatting

- formula

- formulas

- fraction

- fractions

- frame

- free

- freeze

- freezer

- french

- frequencies

- frequency

- freshwater

- fridge

- frigidaire

- from

- fruity

- fuel

- fullback

- function

- functions

- fund

- fundamental

- furniture

- game

- garden

- gardening

- garter

- german

- gland

- glands

- glass

- glucose

- glue

- gluten

- glycemic

- gmail

- goal

- goat

- golden

- golf

- good

- goodbye

- government

- grahams

- graph

- graphing

- gravity

- grease

- great

- greek

- greetings

- grew

- groups

- guide

- guitar

- half

- handicap

- hanging

- happens

- hard

- hardwood

- heat

- heater

- hebrew

- hedge

- hierarchy

- highlight

- hinduism

- hips

- histogram

- history

- hockey

- hominy

- horse

- houses

- how to

- hydrogen

- hyperbola

- hyperlink

- hypotenuse

- icloud

- illustrator

- image

- imap

- imovie

- imperfect

- import

- improper

- impulse

- impulses

- income

- increment

- indent

- index

- indian

- indirect

- individuals

- inferential

- infrastructure

- inheritance

- inprivate

- insert

- inside

- install

- installing

- interest

- interior

- internet

- interval

- investing

- investments

- ionic

- ipad

- iphone

- ipod

- ireland

- israel

- italian

- italicize

- itunes

- jasmine

- java

- jesus

- join

- joined

- journal

- jumper

- jumping

- keeper

- kindle

- kinetic

- knit

- knitted

- knitting

- knocking

- laboratory

- lacrosse

- laptop

- latent

- latitude

- lawn

- laws

- layout

- league

- leaking

- leaks

- leasing

- left

- length

- lenses

- letter

- letterhead

- levels

- lice

- life

- light

- limits

- linear

- list

- liters

- live

- load

- local

- located

- loin

- long

- loose

- loss

- lying

- lymphatic

- macbook

- machine

- macro

- macros

- made

- madness

- main

- maintaining

- make

- management

- mandarin

- manually

- manufacturing

- many

- march

- margin

- marks

- masking

- maslows

- mass

- math

- matlab

- mean

- meaning

- measure

- measuring

- mechanism

- medical

- menu

- merchandise

- message

- metal

- metallic

- metalloid

- metalloids

- metals

- metaphysics

- microsoft

- middle

- minecraft

- minor

- mixed

- mixture

- mode

- model

- modes

- molality

- molarity

- mole

- moles

- monosaccharides

- moral

- mortal

- mosaic

- most

- mountain

- movements

- movies

- much

- muscle

- mushroom

- music

- nails

- name

- names

- natural

- naturally

- need

- needles

- needs

- nerve

- nerves

- network

- neutrality

- nexus

- nikon

- noise

- nonmetal

- nonmetals

- nonpolar

- nook

- normal

- noses

- notation

- notebook

- notes

- nspire

- numbering

- numbers

- numerical

- object

- obligation

- octagon

- odds

- often

- onedrive

- onto

- option

- options

- order

- organs

- origins

- outlook

- output

- oven

- overheats

- ownership

- page

- paint

- paints

- palestine

- pane

- paperwhite

- parabola

- parallelogram

- parathyroid

- parental

- parity

- part

- participle

- partition

- parts

- party

- past

- paste

- payable

- payout

- pegs

- percent

- percentage

- period

- periodic

- periods

- permutations

- pharynx

- phone

- photos

- photoshop

- photosynthesis

- phrases

- physics

- piano

- pipe

- pipes

- planning

- plants

- play

- playing

- playlist

- playstation

- plot

- plots

- plugs

- plunger

- poem

- poetry

- point

- points

- poisonous

- polar

- politics

- polygon

- polygons

- population

- pork

- portfolio

- position

- postulate

- potential

- powered

- powerpoint

- premium

- present

- previous

- price

- problem

- problems

- process

- processor

- profit

- project

- pronounce

- pronouns

- properly

- properties

- property

- pros

- protects

- protein

- proton

- pumped

- punctuate

- puppet

- puppies

- puppy

- pure

- quadrilateral

- quantity

- quantum

- quarterback

- quarters

- queen

- questions

- quick

- quickbooks

- quote

- racing

- radians

- radio

- raising

- range

- rank

- rationalize

- reaction

- reading

- real

- reasoning

- rebel

- recipe

- reconfigure

- record

- recorder

- rectangle

- redstone

- reference

- reflecting

- reform

- refracting

- refrigerator

- regular

- regulations

- reinstall

- relationships

- remove

- remover

- renovating

- repair

- repeater

- replacement

- replacing

- replication

- reset

- residual

- resolution

- restart

- restore

- retained

- retriever

- reverse

- rhombus

- right

- roaming

- roberts

- roku

- roman

- rooms

- rotational

- roulette

- round

- rounds

- router

- rows

- rules

- rummy

- running

- saddle

- saltwater

- sauvignon

- scalene

- schedule

- science

- scientific

- scope

- score

- scored

- scratch

- scratches

- screen

- screensaver

- scripts

- sealing

- secant

- second

- selection

- seller

- seniors

- series

- server

- service

- services

- setting

- settings

- setup

- shades

- shadow

- sharepoint

- sheet

- shooting

- shortcut

- shot

- shutter

- side

- sigma

- sign

- silicon

- silver

- simple

- singing

- siri

- skewed

- skill

- slime

- slow

- small

- snap

- soccer

- socket

- socks

- soft

- soften

- solar

- solder

- solve

- solving

- someone

- something

- song

- songs

- sonnet

- sound

- space

- spades

- spanish

- spark

- speaking

- speed

- split

- sports

- spotify

- spring

- spss

- squeaky

- standard

- start

- starting

- state

- statement

- states

- static

- statistics

- stats

- step

- stock

- stocks

- storage

- strap

- strategic

- strategy

- streetlights

- string

- styles

- subsetting

- substance

- sugar

- sugars

- summary

- sums

- supplementary

- support

- switch

- swype

- symbols

- sync

- synthesis

- system

- table

- tablet

- tactical

- take

- tangent

- tank

- taxes

- team

- telescope

- temperature

- tennis

- tense

- term

- terms

- test

- testate

- testing

- tether

- their

- theorem

- theory

- theta

- thigh

- things

- through

- tile

- time

- timeline

- timer

- timing

- tips

- toilet

- tone

- tool

- tools

- torch

- toshiba

- tour

- trading

- training

- transfer

- transitive

- trash

- triangle

- triangles

- tricks

- trig

- trigonometry

- trim

- troubleshoot

- troubleshooting

- truck

- truss

- tune

- tuners

- turn

- tutorial

- type

- types

- typing

- unallocated

- unclog

- uncollectible

- under

- understanding

- undo

- unfriending

- unhide

- uninstall

- united

- unix

- upgrade

- urinary

- using

- value

- values

- vaporization

- variable

- variables

- vegan

- verb

- verbs

- video

- view

- violin

- vista

- vocals

- voicemail

- volume

- voting

- waist

- wake

- warp

- washing

- water

- watermarks

- wedding

- week

- weight

- were

- wether

- what

- whats

- when

- where

- which

- whisker

- width

- wifi

- wilsons

- win7

- window

- windows

- wine

- winning

- winxp

- wire

- wireless

- with

- wont

- wooden

- woodrow

- word

- work

- working

- workplace

- world

- wrestling

- write

- writing

- xbox

- yarn

- your

- zeros

- zoom

-

Adjust the Truss Rod 1. Decrease Relief Tightening the truss rod by turning it clockwise influences the neck to curve upward toward the stri...

-

Divide this by 100 to get 68 which means 68 is 20 of 340. As a fraction 10 200 005. Percentages Fast Math Lesson Youtube 10 200 x 100 5. ...

-

Double-entry bookkeeping is the process that most businesses use to produce their accounts. Double entry bookkeeping is where the value from...