Calculate beginning inventory Find your beginning inventory amount for the period you are calculating COGS for. Also operating income is an official.

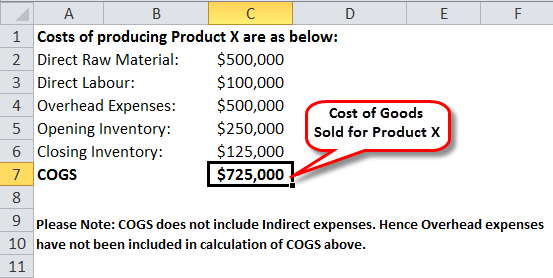

Cost Of Goods Sold Formula Calculator Excel Template

Cost Of Goods Sold Formula Calculator Excel Template

How To Calculate Cost of Goods Sold Cost of Goods Sold and Inventory.

How to calculate cogs. It is the cost of acquiring or manufacturing the products you are selling during a period of time. Linking COGM to COGS Once all the individual parts are calculated and used to figure out the total cost of goods manufactured for the year this COGM value is then transferred to a final inventory account called the Finished Goods Inventory account and used to calculate Cost of Goods Sold. Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year.

How to calculate cost of goods sold Determine your beginning inventory. Average cost is not only an acceptable reporting method but also. Find out the average cost of purchased inventory.

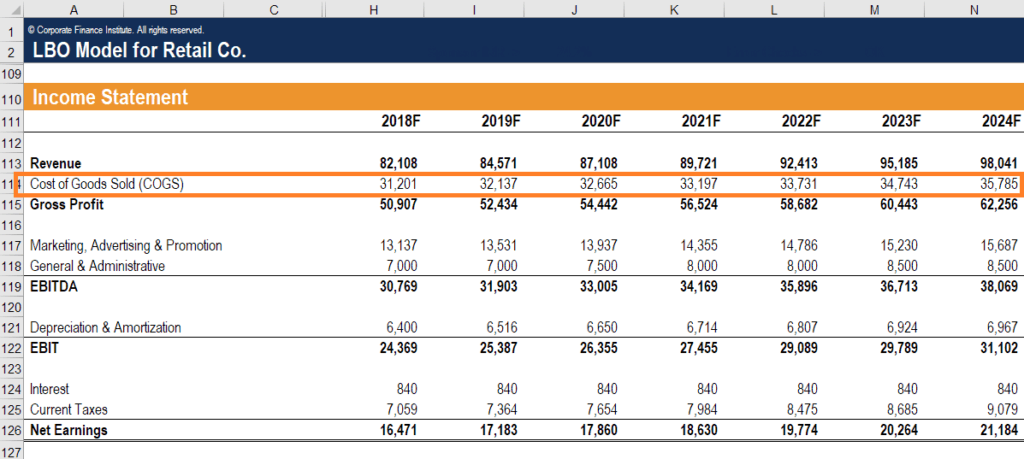

Information for the COGS Calculation. If youre calculating for the calendar year youll use your beginning inventory as. COGS is then subtracted from the total revenue to arrive at the gross margin.

It doesnt include expenses like distribution or sales costs. Lets take a look at how to calculate cost of goods sold. The only costs included are directly tied to the production of your products which may include labor materials and shipping.

The final number will be the yearly cost of goods sold for your business. However while calculating operating income only the income from operations is accounted for. Cost of Goods Sold COGS or cost of sales is the money spent on producing the products the firm sells eg costs of the materials and labour.

There is an exception to this rule for small businesses. The formula for COGS is as below. Add the beginning inventory and the additional inventory costs.

A periodic inventory method means that inventory is calculated at regular intervals. Depreciation refers to the decrease in your assets values over time. Find out the average cost of the goods you produced.

For example you may count inventory monthly quarterly or semi-annually. Cost of Goods Sold COGS is a critical financial metric calculating the direct cost of the goods a company sells during a given time period. Using Average Inventory Cost 1.

COGS stands for Cost of Goods Sold. Reducing your COGS can help you increase profit without increasing sales. Beginning Inventory Purchases Ending Inventory COGS.

Apart from material costs COGS also consists of labor costs and direct factory overhead. The Basic Cost of Goods. 1 801 804-5800 email protected Facebook.

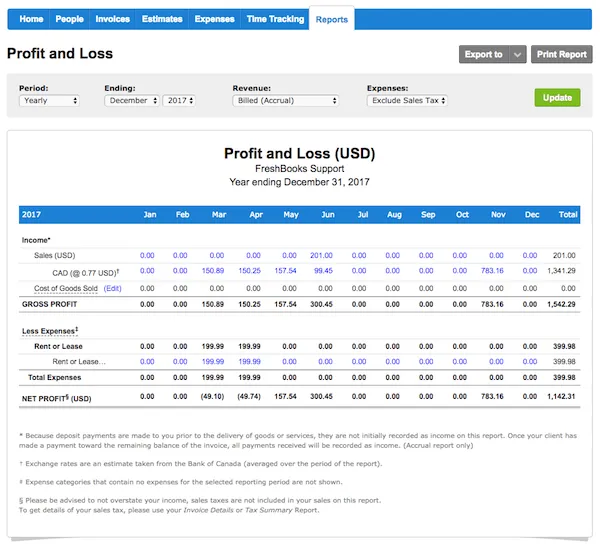

COGS or COS is the first expense youll see on your profit and loss PL statement and is a critical component when calculating your businesss gross margin. Cost of Goods Sold COGS refers to the costs associated with acquiring or manufacturing goods to be sold by a company during a specific period of time. Then subtract the cost of inventory remaining at the end of the year.

The formula is straightforward in this case. Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. Calculate the cost of goods sold COGS if using a periodic inventory method.

The calculation of the cost of goods sold is focused on the value of your businesss. Cost of goods sold COGS is the total value of direct costs related to producing goods sold by a business. Cost Of Goods Sold Opening Inventory Purchases Closing Inventory For example a service-based business charges the goods it uses to its clients.

Cost of Goods Sold Beginning Inventory Purchases - Ending Inventory For example if a business has a beginning inventory worth of 200000 and ending inventory of 50000 with new purchases of 300000 the cost of goods sold can be solve with the above COGS formula. Example - You run a bakery and you have decided to calculate the cost of goods sold for the past month. Following is the COGS formula on how to calculate cost of goods sold.

The business had a closing inventory of 1000 in the previous period which is the opening inventory for the current period. To calculate the cost of goods sold COGS for periodic inventory system we need to select the accounting period for which you want to calculate the cost of goods sold COGS. Formula to Calculate Cost of Goods Sold COGS Cost of Goods Sold Formula COGS calculates all the direct costs which are associated with the production of the various goods sold by the company and it is calculated by adding the beginning inventory of the company with the total purchases during the year and then subtracting the value of the closing inventory of the company from it.

Take a physical inventory. If instead your company purchases raw materials and then. Subtract the ending inventory.

It includes only those costs that are directly incurred in order to manufacture the goods including the cost of labor raw material and overhead expenditure related to the manufacturing of goods to be sold.

What Is Cost Of Goods Sold Cogs And How To Calculate It

What Is Cost Of Goods Sold Cogs And How To Calculate It

Cost Of Goods Sold How To Calculate It And What Goes Into Cogs

Cost Of Goods Sold How To Calculate It And What Goes Into Cogs

Cost Of Goods Sold Cogs Definition Formula More

Cost Of Goods Sold Cogs Definition Formula More

Calculating Cost Of Goods Sold For Ecommerce Glew

Calculating Cost Of Goods Sold For Ecommerce Glew

Cost Of Goods Sold Cogs In A Startup Business Plan Plan Projections

Cost Of Goods Sold Cogs In A Startup Business Plan Plan Projections

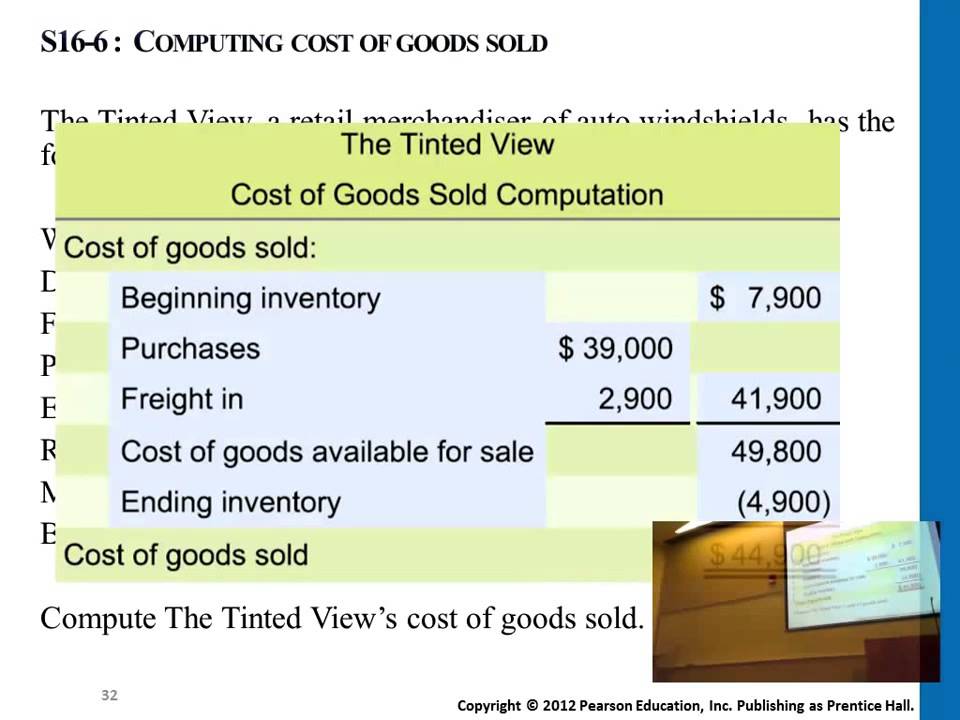

How To Compute The Cost Of Goods Sold Youtube

How To Compute The Cost Of Goods Sold Youtube

Cost Of Goods Sold Formula How To Calculate Cogs

Cost Of Goods Sold Formula How To Calculate Cogs

Sales Cost Of Goods Sold And Gross Profit

Sales Cost Of Goods Sold And Gross Profit

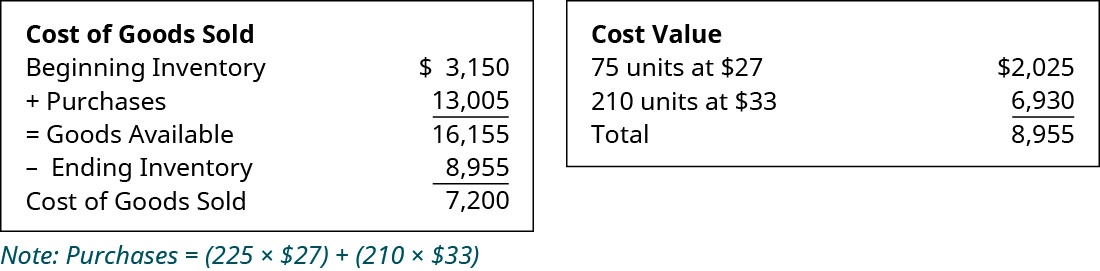

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

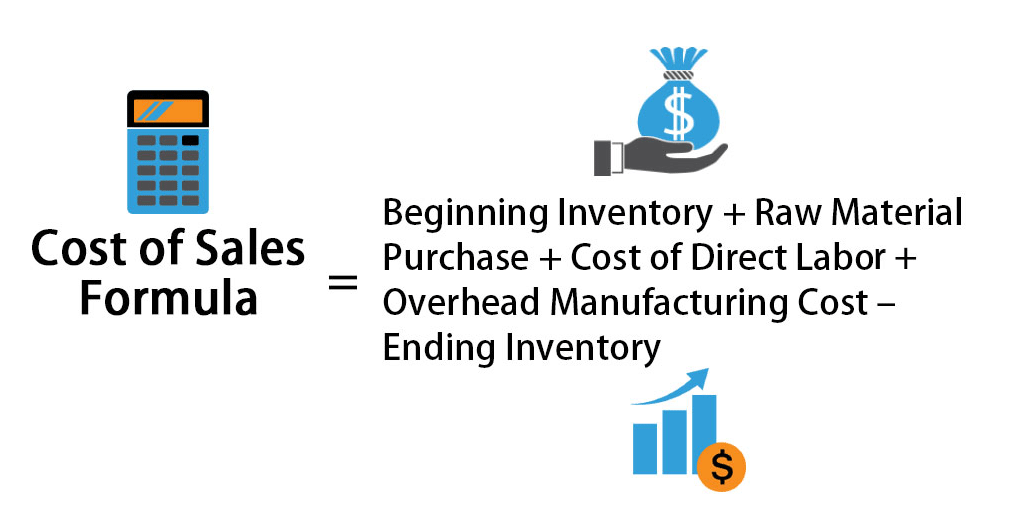

Cost Of Sales Formula Calculator Examples With Excel Template

Cost Of Sales Formula Calculator Examples With Excel Template

Cost Of Goods Sold On An Income Statement Definition Formula Video Lesson Transcript Study Com

Cost Of Goods Sold On An Income Statement Definition Formula Video Lesson Transcript Study Com