The ending balance of a cash-flow statement will always equal the cash amount shown on the companys balance sheet. This will provide the adjusted bank cash balance.

How To Balance Your Balance Sheet Financial Modeling Tutorial

It is usually measured at the end of a reporting period as part of the closing process.

Ending cash balance formula. The ending balance is the net residual balance in an account. Deduct any outstanding checks. Formula to Calculate Balance Sheet.

Subtract each accounts total credits from each result to calculate each accounts year-end balance. Example of the Adjusted Balance Method. This equals an ending cash balance of 17000.

The accounting closing balance refers to the amount carried forward to the next accounting period. Next use the companys ending cash balance add any interest earned and notes receivable amount. It equals the cash and cash equivalents line on the balance sheet.

Or create a VBA macro to do it for you. Assets liabilities equity or assets liabilities equity This basic formula must stay in balance to generate an. The card holder makes 350 of additional purchases during the month and pays down the account.

10 Useful Accounting Formulas. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending. At the end of each accounting period retained earnings are reported on the balance sheet as the accumulated income from the prior year including the current years income minus dividends paid to shareholders.

Once again use formulas to figure these sums. John you would first need to calculate the remaining comp time end balance beginning balance total earned total used. This being said to calculate cash flow in this way youll use the following formula.

The Closing Balance is the amount of cash at the end of the month last day of month. Operating income earnings. Compute your Ending Cash Balance for each accounting period.

Cash balance is the amount of money on hand. Brought to you by Techwalla. The Closing Balance is calculated by the following equation.

Having a negative cash flow every so often for a month isnt a big problem. The ending balance is calculated as follow. Using the cash balance shown on the bank statement add back any deposits in transit.

In the row labeled Ending Cash Balance record the sum of your Beginning Cash Total Cash Receipts and Total Cash Disbursements for each accounting period. On the other hand a closing balance in banking refers to the bank balance at end of a business day month or year. Closing Balance Opening Balance add Total of Income less Total of Expenditure.

On the cash flows statement ending Cash is the amount of cash a company has when adding the change in cash and beginning cash balance for the current fiscal period. Yes a cash balance plan formula can be designed to provide credits based on both age and service. For example subtract 8000 in total credits in your cash account from your result of 25000.

This assumes that all employees are eligible and included in the calculation. Under this type of arrangement the percentage of plan salary which the participant receives as an annual credit is based on the sum of the employees age and years of service. Balance sheet formula which states that sum of the total liabilities and the owners capital is equal to the companys total assets is one of the most fundamental parts of the accounting on which the whole double entry system of accounting is based.

Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance Ending cash balance. But before you delete the data to start the new timesheet you would need to enter the end balance into the beginning balance manually. Beginning balance 105 W2 compensation 4.

Deduct any bank service fees penalties and NSF checks. For example a credit card has a beginning balance of 500. You get that by taking the previous months cash balance and adding this months cash flow to it which means subtracting if the cash flow is negative.

Brought to you by Techwalla. It is the difference between credits and debits in a ledger at the end of one accounting period that is carried forward to the next. You should never have a negative cash balance.

What is the Ending Balance. 44K views View 2 Upvoters. An ending balance is derived by adding up the transaction totals in an account and then adding this total to the beginning balance.

Similarly a bank using this method calculates the interest income that an account holder earns for a month based on the ending balance in the account. Cash flow is by definition the change in a companys cash from one period to.

Startup Financial Modeling Part 4 The Balance Sheet Cash Flow And Unit Economics

Revolver Formula How To Model A Revolver In Excel Wall Street Prep

How To Prepare A Statement Of Cash Flows 13 Steps With Pictures

Startup Financial Modeling Part 4 The Balance Sheet Cash Flow And Unit Economics

Downloadable Calculator Free Cash Flow Formula Deputy

Solved Ll Skincare S Ending Cash Balance As Of January 1 Chegg Com

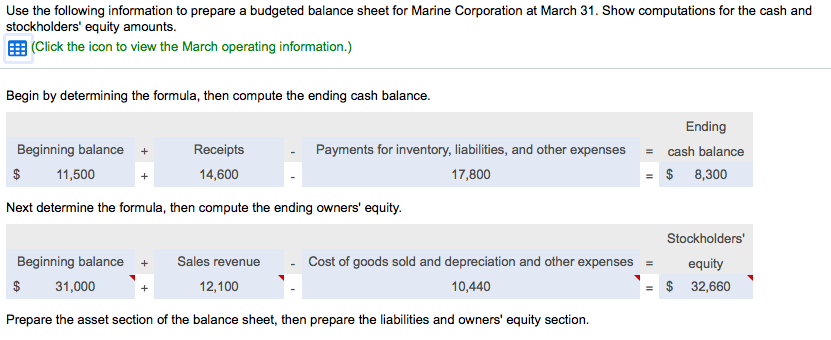

Solved Use The Following Information To Prepare A Budgete Chegg Com

Calculating The Cash Balance Online Financial Modeling Training Kubicle

How To Calculate The Ending Cash Balance Quora

You Can Understand Your Cash Flow In Less Than 10 Minutes

How To Calculate Cash Flow The Ultimate Guide For Small Businesses

Cash Flow Forecasting Example Startup Business Tutor2u

How To Calculate Cash Flow The Ultimate Guide For Small Businesses

Cash Flow Statement Analyzing Cash Flow From Investing Activities

ads

Slide Course

Search This Blog

Blog Archive

- January 2023 (3)

- July 2021 (2)

- June 2021 (72)

- May 2021 (26)

- March 2021 (12)

- February 2021 (19)

- January 2021 (19)

- December 2020 (21)

- November 2020 (7)

- October 2020 (8)

- September 2020 (53)

- August 2020 (10)

- July 2020 (8)

- June 2020 (25)

- May 2020 (25)

- April 2020 (25)

- March 2020 (17)

- January 2020 (20)

- December 2019 (41)

- November 2019 (49)

- October 2019 (76)

- September 2019 (40)

- August 2019 (35)

- July 2019 (34)

- June 2019 (16)

- May 2019 (6)

- April 2019 (30)

- March 2019 (44)

- February 2019 (42)

- January 2019 (43)

- December 2018 (19)

- November 2018 (18)

- October 2018 (2)

Labels

- 1041

- 11th

- 12th

- 16th

- 2007

- 2010

- 2013

- 401k

- 75th

- 85th

- abbreviations

- abreviation

- acceleration

- account

- accounting

- accounts

- action

- activate

- active

- actual

- adding

- additional

- address

- adhesion

- adjectives

- administration

- adobe

- advisor

- aerate

- aero

- agent

- algebra

- alive

- always

- amendment

- amendments

- amps

- analysis

- anatomical

- android

- angle

- angles

- angular

- animate

- another

- anti

- anyone

- aperture

- apple

- archaea

- area

- aristotle

- armed

- armor

- artistic

- asvab

- asymptotes

- atah

- atoms

- audio

- australia

- autobiography

- autofill

- autosum

- average

- bacardi

- back

- backup

- bacteria

- bags

- balance

- banging

- baptism

- baruch

- basic

- basics

- basket

- basketball

- bass

- battery

- beans

- beds

- beef

- beer

- beginners

- being

- beliefs

- belly

- beneficiaries

- best

- betting

- between

- bidder

- bidding

- billing

- binomial

- binomials

- biogeography

- biology

- bisector

- blend

- blood

- bobbers

- boil

- bonds

- book

- bookkeeping

- borax

- borrow

- brake

- breaker

- bridge

- browsing

- build

- burn

- business

- buttocks

- button

- buying

- cables

- calculate

- calculating

- calculator

- calculus

- call

- called

- camera

- canon

- capitalized

- card

- cards

- care

- careers

- cash

- caste

- categorical

- catholic

- caulk

- caused

- causes

- centripetal

- centroid

- chalk

- change

- chart

- charts

- cheat

- check

- chemical

- chemistry

- chess

- chickens

- chord

- chords

- chromebook

- church

- circle

- circles

- circuit

- circular

- circulatory

- circumference

- class

- classical

- clean

- cleanup

- clicking

- clone

- clothes

- cloud

- club

- clubs

- coastal

- coding

- coefficients

- cogs

- cohesion

- cold

- college

- columns

- command

- commandments

- commas

- comments

- commodities

- common

- commons

- communication

- company

- compatible

- competitive

- complementary

- compost

- compute

- computer

- concrete

- conditional

- conditioning

- conduction

- conf

- confidence

- confirmation

- congruence

- congruent

- conjugating

- connect

- connecting

- connection

- cons

- constant

- constitution

- contacts

- continuous

- continuum

- contribution

- control

- controls

- convert

- cooker

- cookies

- cooking

- copper

- corinthian

- cornstarch

- cost

- costing

- cover

- craft

- crafting

- create

- critical

- crochet

- crop

- crossfit

- cubic

- current

- curtain

- curve

- cycle

- d3100

- d7000

- d7100

- data

- days

- decimal

- decimals

- decrease

- default

- define

- definition

- defrag

- defragment

- defragmenter

- degree

- delete

- deleting

- demand

- dent

- depreciation

- depression

- derivative

- derivatives

- descriptive

- design

- desktop

- deviation

- deviations

- diabetes

- diagonals

- diagram

- diamond

- diesel

- diet

- difference

- different

- differential

- dimmer

- direct

- directory

- disable

- disk

- displacement

- disposal

- distances

- distributing

- distribution

- division

- document

- does

- dogs

- domo

- down

- download

- dragon

- drainage

- drinks

- drywall

- dummies

- dural

- dutch

- earned

- earnings

- east

- eastern

- easy

- ebay

- economic

- economics

- edges

- effusion

- eggs

- elasticity

- electronics

- elements

- eleventh

- embryology

- empty

- ending

- endings

- endosymbiosis

- energy

- engine

- entries

- entry

- equation

- equations

- equilibrium

- equivalent

- estate

- ethernet

- euthanize

- evolution

- example

- examples

- excel

- exchange

- exercises

- expense

- explained

- explorer

- exponential

- exponents

- facetime

- factorial

- factory

- families

- fantasy

- fatter

- feather

- federal

- feeding

- fence

- fertilize

- fiction

- fifths

- fight

- fighting

- file

- filing

- fill

- final

- financial

- find

- fire

- first

- fish

- fishermans

- fishing

- fixed

- fixing

- flash

- flipping

- floating

- floor

- floors

- florida

- flow

- flower

- fluid

- food

- football

- footnote

- footnotes

- force

- forces

- form

- format

- formatting

- formula

- formulas

- fraction

- fractions

- frame

- free

- freeze

- freezer

- french

- frequencies

- frequency

- freshwater

- fridge

- frigidaire

- from

- fruity

- fuel

- fullback

- function

- functions

- fund

- fundamental

- furniture

- game

- garden

- gardening

- garter

- german

- gland

- glands

- glass

- glucose

- glue

- gluten

- glycemic

- gmail

- goal

- goat

- golden

- golf

- good

- goodbye

- government

- grahams

- graph

- graphing

- gravity

- grease

- great

- greek

- greetings

- grew

- groups

- guide

- guitar

- half

- handicap

- hanging

- happens

- hard

- hardwood

- heat

- heater

- hebrew

- hedge

- hierarchy

- highlight

- hinduism

- hips

- histogram

- history

- hockey

- hominy

- horse

- houses

- how to

- hydrogen

- hyperbola

- hyperlink

- hypotenuse

- icloud

- illustrator

- image

- imap

- imovie

- imperfect

- import

- improper

- impulse

- impulses

- income

- increment

- indent

- index

- indian

- indirect

- individuals

- inferential

- infrastructure

- inheritance

- inprivate

- insert

- inside

- install

- installing

- interest

- interior

- internet

- interval

- investing

- investments

- ionic

- ipad

- iphone

- ipod

- ireland

- israel

- italian

- italicize

- itunes

- jasmine

- java

- jesus

- join

- joined

- journal

- jumper

- jumping

- keeper

- kindle

- kinetic

- knit

- knitted

- knitting

- knocking

- laboratory

- lacrosse

- laptop

- latent

- latitude

- lawn

- laws

- layout

- league

- leaking

- leaks

- leasing

- left

- length

- lenses

- letter

- letterhead

- levels

- lice

- life

- light

- limits

- linear

- list

- liters

- live

- load

- local

- located

- loin

- long

- loose

- loss

- lying

- lymphatic

- macbook

- machine

- macro

- macros

- made

- madness

- main

- maintaining

- make

- management

- mandarin

- manually

- manufacturing

- many

- march

- margin

- marks

- masking

- maslows

- mass

- math

- matlab

- mean

- meaning

- measure

- measuring

- mechanism

- medical

- menu

- merchandise

- message

- metal

- metallic

- metalloid

- metalloids

- metals

- metaphysics

- microsoft

- middle

- minecraft

- minor

- mixed

- mixture

- mode

- model

- modes

- molality

- molarity

- mole

- moles

- monosaccharides

- moral

- mortal

- mosaic

- most

- mountain

- movements

- movies

- much

- muscle

- mushroom

- music

- nails

- name

- names

- natural

- naturally

- need

- needles

- needs

- nerve

- nerves

- network

- neutrality

- nexus

- nikon

- noise

- nonmetal

- nonmetals

- nonpolar

- nook

- normal

- noses

- notation

- notebook

- notes

- nspire

- numbering

- numbers

- numerical

- object

- obligation

- octagon

- odds

- often

- onedrive

- onto

- option

- options

- order

- organs

- origins

- outlook

- output

- oven

- overheats

- ownership

- page

- paint

- paints

- palestine

- pane

- paperwhite

- parabola

- parallelogram

- parathyroid

- parental

- parity

- part

- participle

- partition

- parts

- party

- past

- paste

- payable

- payout

- pegs

- percent

- percentage

- period

- periodic

- periods

- permutations

- pharynx

- phone

- photos

- photoshop

- photosynthesis

- phrases

- physics

- piano

- pipe

- pipes

- planning

- plants

- play

- playing

- playlist

- playstation

- plot

- plots

- plugs

- plunger

- poem

- poetry

- point

- points

- poisonous

- polar

- politics

- polygon

- polygons

- population

- pork

- portfolio

- position

- postulate

- potential

- powered

- powerpoint

- premium

- present

- previous

- price

- problem

- problems

- process

- processor

- profit

- project

- pronounce

- pronouns

- properly

- properties

- property

- pros

- protects

- protein

- proton

- pumped

- punctuate

- puppet

- puppies

- puppy

- pure

- quadrilateral

- quantity

- quantum

- quarterback

- quarters

- queen

- questions

- quick

- quickbooks

- quote

- racing

- radians

- radio

- raising

- range

- rank

- rationalize

- reaction

- reading

- real

- reasoning

- rebel

- recipe

- reconfigure

- record

- recorder

- rectangle

- redstone

- reference

- reflecting

- reform

- refracting

- refrigerator

- regular

- regulations

- reinstall

- relationships

- remove

- remover

- renovating

- repair

- repeater

- replacement

- replacing

- replication

- reset

- residual

- resolution

- restart

- restore

- retained

- retriever

- reverse

- rhombus

- right

- roaming

- roberts

- roku

- roman

- rooms

- rotational

- roulette

- round

- rounds

- router

- rows

- rules

- rummy

- running

- saddle

- saltwater

- sauvignon

- scalene

- schedule

- science

- scientific

- scope

- score

- scored

- scratch

- scratches

- screen

- screensaver

- scripts

- sealing

- secant

- second

- selection

- seller

- seniors

- series

- server

- service

- services

- setting

- settings

- setup

- shades

- shadow

- sharepoint

- sheet

- shooting

- shortcut

- shot

- shutter

- side

- sigma

- sign

- silicon

- silver

- simple

- singing

- siri

- skewed

- skill

- slime

- slow

- small

- snap

- soccer

- socket

- socks

- soft

- soften

- solar

- solder

- solve

- solving

- someone

- something

- song

- songs

- sonnet

- sound

- space

- spades

- spanish

- spark

- speaking

- speed

- split

- sports

- spotify

- spring

- spss

- squeaky

- standard

- start

- starting

- state

- statement

- states

- static

- statistics

- stats

- step

- stock

- stocks

- storage

- strap

- strategic

- strategy

- streetlights

- string

- styles

- subsetting

- substance

- sugar

- sugars

- summary

- sums

- supplementary

- support

- switch

- swype

- symbols

- sync

- synthesis

- system

- table

- tablet

- tactical

- take

- tangent

- tank

- taxes

- team

- telescope

- temperature

- tennis

- tense

- term

- terms

- test

- testate

- testing

- tether

- their

- theorem

- theory

- theta

- thigh

- things

- through

- tile

- time

- timeline

- timer

- timing

- tips

- toilet

- tone

- tool

- tools

- torch

- toshiba

- tour

- trading

- training

- transfer

- transitive

- trash

- triangle

- triangles

- tricks

- trig

- trigonometry

- trim

- troubleshoot

- troubleshooting

- truck

- truss

- tune

- tuners

- turn

- tutorial

- type

- types

- typing

- unallocated

- unclog

- uncollectible

- under

- understanding

- undo

- unfriending

- unhide

- uninstall

- united

- unix

- upgrade

- urinary

- using

- value

- values

- vaporization

- variable

- variables

- vegan

- verb

- verbs

- video

- view

- violin

- vista

- vocals

- voicemail

- volume

- voting

- waist

- wake

- warp

- washing

- water

- watermarks

- wedding

- week

- weight

- were

- wether

- what

- whats

- when

- where

- which

- whisker

- width

- wifi

- wilsons

- win7

- window

- windows

- wine

- winning

- winxp

- wire

- wireless

- with

- wont

- wooden

- woodrow

- word

- work

- working

- workplace

- world

- wrestling

- write

- writing

- xbox

- yarn

- your

- zeros

- zoom

-

Adjust the Truss Rod 1. Decrease Relief Tightening the truss rod by turning it clockwise influences the neck to curve upward toward the stri...

-

Divide this by 100 to get 68 which means 68 is 20 of 340. As a fraction 10 200 005. Percentages Fast Math Lesson Youtube 10 200 x 100 5. ...

-

Double-entry bookkeeping is the process that most businesses use to produce their accounts. Double entry bookkeeping is where the value from...

About Me